NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, WITHIN OR TO THE UNITED STATES, AUSTRALIA, BELARUS, JAPAN, CANADA, NEW ZEALAND, RUSSIA, SWITZERLAND, SINGAPORE, SOUTH AFRICA, SOUTH KOREA OR ANY OTHER JURISDICTION WHERE RELEASE, DISTRIBUTION OR PUBLICATION OF THIS PRESS RELEASE WOULD BE UNLAWFUL OR WOULD REQUIRE FURTHER REGISTRATION OR ANY OTHER MEASURES.

Today, 20 October 2023, the subscription period begins in JonDeTech Sensors AB’s (publ) (“JonDeTech” or the “Company”) rights issue of units consisting of shares and warrants (the “Rights Issue”), which the board of directors resolved on 13 September 2023 and was approved at the extraordinary general meeting on 16 October 2023. The subscription period in the Rights Issue runs from and including 20 October 2023, up to and including 3 November 2023. However, note that some banks and nominees may have an earlier deadline for subscription in the Rights Issue. Shareholders should therefore check with their bank or nominee if they have an earlier deadline for subscription.

Timetable for the Rights Issue

- 18 October 2023: Record date for obtaining unit rights. Shareholders who are registered in the share register kept by Euroclear Sweden AB on this day, receive unit rights for participation in the Rights Issue.

- 20 October – 3 November 2023: Trading with unit rights on Nasdaq First North Growth Market

- 20 October – 31 October 2023: Subscription period for the Rights Issue

- 20 October – week 47, 2023: Trading with BTU on Nasdaq First North Growth Market

- 7 November 2023: Estimated date for publication of issue results

Subscription with preferential rights

The shareholders who, on the record date of 18 October 2023, were registered in the share register maintained by Euroclear Sweden AB (“Euroclear”) and on behalf of the Company, directly registered shareholders, receive a pre-printed issue report with attached payment advice from Euroclear. In the event that a different number of unit rights than those stated in the preprinted issue report are used for subscription the special application form, which is available on the Company’s website www.jondetech.se and Mangold’s website emission.mangold.se, shall be used as a basis for subscription through cash payment.

Shareholders whose holdings of shares in the Company were nominee-registered with a bank or other nominee on the record date do not receive an issue report or a special application form from Euroclear. Subscription and payment must then instead take place in accordance with instructions from the respective trustee.

Subscription without preferential rights

Notification of subscription without preferential rights by a nominee is made in accordance with instructions from the respective nominee. For subscription through an endowment insurance or an investment savings account, please contact your nominee. Application for subscription without preferential rights in other respects is done by sending an application form by e-mail to Mangold or alternatively by electronic subscription with Bank ID on Mangold’s website. Application form and electronic subscription are available on Mangold’s website emission.mangold.se.

Advisors

Mangold Fondkommission AB is financial advisor and Eversheds Sutherland Advokatbyrå is legal advisor to JonDeTech in connection with the Rights Issue.

For more information, please contact:

Dean Tosic, CEO, E-mail: [email protected], www.jondetech.se

About JonDeTech

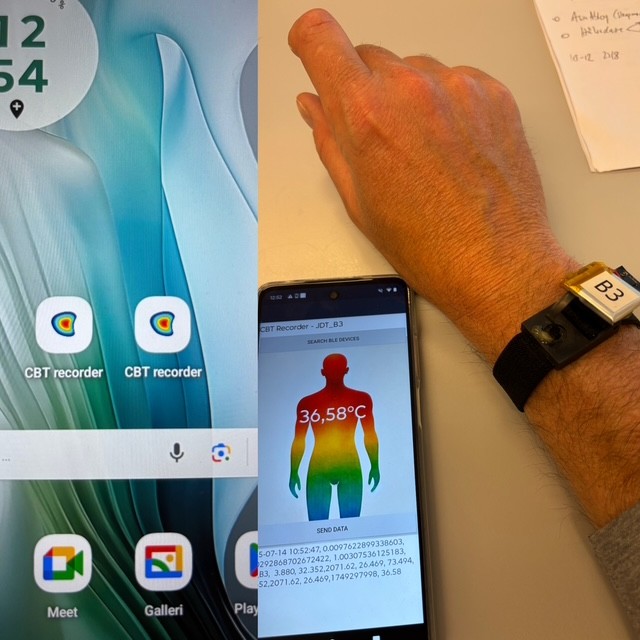

JonDeTech is a supplier of sensor technology. The Company markets a portfolio of IR sensor elements based on proprietary nanotechnology and silicon MEMS. The nanoelements are extremely thin, built-in flexible plastic, and can be manufactured in high volumes at a low cost, which opens up for a variety of applications, such as temperature and heat flow measurements, presence detection, and gas detection. The Company is listed on Nasdaq First North Growth Market. Redeye is the Company’s Certified Adviser. Read more at www.jondetech.se or see how the IR sensor works at https://www.youtube.com/watch?v=mORloeCxbPE.

Important information

The information in this press release neither contains nor constitutes an offer to acquire, subscribe, or otherwise trade shares, subscription options, or other securities in JonDeTech. No action has been taken, and no action will be taken, to permit a public offering in any jurisdiction other than Sweden. The invitation to eligible persons to subscribe for units in JonDeTech will only be made through the Prospectus, which was published by the Company on 18 October 2023 on JonDeTechs’s website, www.jondetech.se. However, this press release is not a prospectus within the meaning of Regulation (EU) 2017/1129 (the “Prospectus Regulation“) and this press release does not identify or purport to identify risks (direct or indirect) that may be associated with an investment in shares, subscription options, or other securities in JonDeTech. The information in this press release is provided solely for the purpose of describing the background to the Preferential Issue and makes no claim to be complete or exhaustive. No representation shall be made with respect to the accuracy or completeness of the information in this press release. Any investment decision should, for an investor to fully understand the potential risks and benefits associated with the decision to participate in the Preferential Issue, be made solely on the basis of the information in the Prospectus. Therefore, it is recommended that an investor reads the entire Prospectus. This press release constitutes marketing in accordance with Article 2 k of the Prospectus Regulation.

The information in this press release may not be published, published or distributed, directly or indirectly, in or to the United States, Australia, Belarus, Japan, Canada, New Zealand, Russia, Switzerland, Singapore, South Africa, South Korea or any other jurisdiction where such action would be unlawful, subject to legal restrictions or require actions other than those required by Swedish law. Actions in violation of this instruction may constitute a violation of applicable securities laws. No shares, subscription options, or other securities in JonDeTech have been registered, and no shares, subscription options, or other securities will be registered, under the then-current United States Securities Act of 1933 (the “Securities Act“) or the securities laws of any state or other jurisdiction in the United States and may not be offered, sold, or otherwise transferred, directly or indirectly, in or to the United States, except in accordance with an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in accordance with the securities laws of the relevant state or other jurisdiction in the United States.

In the United Kingdom, this document and any other material relating to the securities referred to herein is only directed at, and any investment or investment activity to which this document relates is available only to, and will be engaged in only with, “qualified investors” who are (i) persons who have professional experience in matters relating to investments and who fall within the definition of “professional investors” in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order“); or (ii) high net worth entities falling within Article 49(2)(a)-(d) of the Order (all such persons together being referred to as “relevant persons”). Any investment or investment activity to which this press release relates in the United Kingdom is available only to relevant persons and will be engaged in only with relevant persons. Persons who are not relevant persons should not take any action based on this press release and should not act or rely on it.

Forward-Looking Statements:

This press release contains forward-looking statements concerning the Company’s intentions, assessments, or expectations regarding the Company’s future results, financial position, liquidity, development, prospects, expected growth, strategies, and opportunities, as well as the markets in which the Company operates. Forward-looking statements are statements that do not concern historical facts and can be identified by expressions such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “will,” “may,” “assumes,” “should,” “could,” and, in each case, negations thereof, or similar expressions. The forward-looking statements in this press release are based on various assumptions, many of which are based on additional assumptions. While the Company believes that the assumptions reflected in these forward-looking statements are reasonable, it cannot be guaranteed that they will materialize or that they are correct. Since these assumptions are based on assumptions or estimates and are subject to risks and uncertainties, the actual results or outcomes, for many different reasons, may significantly deviate from what is stated in the forward-looking statements. Such risks, uncertainties, contingencies, and other significant factors may cause the actual development of events to materially differ from the expectations expressly or implicitly stated in this press release through the forward-looking statements. The Company does not guarantee that the assumptions underlying the forward-looking statements in this press release are accurate, and each reader of the press release should not unreasonably rely on the forward-looking statements in this press release. The information, opinions, and forward-looking statements expressly or implicitly contained herein are provided only as of the date of this press release and may change. Neither the Company nor anyone else undertakes to review, update, confirm, or publicly announce any revisions to any forward-looking statement to reflect events that occur or circumstances that arise regarding the content of this press release, unless required by law or Nasdaq rules for issuers.