JonDeTech Sensors AB (publ) (“JonDeTech” or the “Company”) hereby announces that the Board of Directors, pursuant to the authorisation granted by the general meeting on 28 June 2023, has resolved on two directed share issues to Nordic Growth Opportunities 1 (the “Investor”). The issues are carried out because the Investor, in accordance with the financing agreement that JonDeTech announced through a press release on 29 April 2023 (the “Financing Agreement”), has requested subscription of shares in the Company of a total amount exceeding half of the value of shares lent in connection with the Agreement.

The Board of Directors of JonDeTech has today resolved on two directed share issues to the Investor (the “Directed Share Issues“). The reason for the deviation from the shareholders’ preferential rights is to fulfill the terms under the Financing Agreement. The background to the resolutions is that the Investor has requested subscription of shares in the Company of an amount exceeding the value of shares lent in connection with the Financing Agreement. According to the Financing Agreement, the Company shall therefore resolve to issue shares at a value corresponding to the amount requested by the Investor for subscription.

The investor has called for subscription of shares on two different occasions corresponding to a total value of SEK 350,000. The subscription price for the Directed Share Issues amounts to SEK 0.10 has been calculated in accordance with the terms and conditions of the Financing Agreement, which corresponds to ninety-five per cent (95%) of the average of the second (2nd) and third (3rd) lowest daily volume weighted average price during ten (10) trading days (“VWAP period“) prior to the respective request for subscription of shares, according to Nasdaq First North Growth Market’s price list for the share in the Company. Taking into account the terms and conditions of the Financing Agreement, the Board considers that the subscription price in the Directed Share Issues is secured on market terms. The reason for the deviation from the shareholders’ preferential rights is to fulfil the terms of the Financing Agreement, which the Board of Directors considers to be in the interest of all shareholders.

Payment for the subscribed shares has been made by partial set-off of the tranches paid to the Company under the Financing Agreement. The other terms of the Directed Share Issues are set out below:

- 1,000,000 shares are issued at a price of SEK 0.10 resulting in an increase of the share capital by approximately SEK 38,217.53.

- 2,500,000 shares are issued at a price of SEK 0.10 resulting in an increase of the share capital by approximately SEK 95,543.84.

The Directed Share Issues entail that the Company’s share capital in total increases by approximately SEK 133,761.37. The number of shares in the Company will increase by 3,500,000 shares. The Directed Share Issues result in the number of shares amounting to 139,848,299. The Directed Share Issues entail a total dilution for existing shareholders of approximately 2.5 per cent of the number of shares and votes in the Company.

About JonDeTech

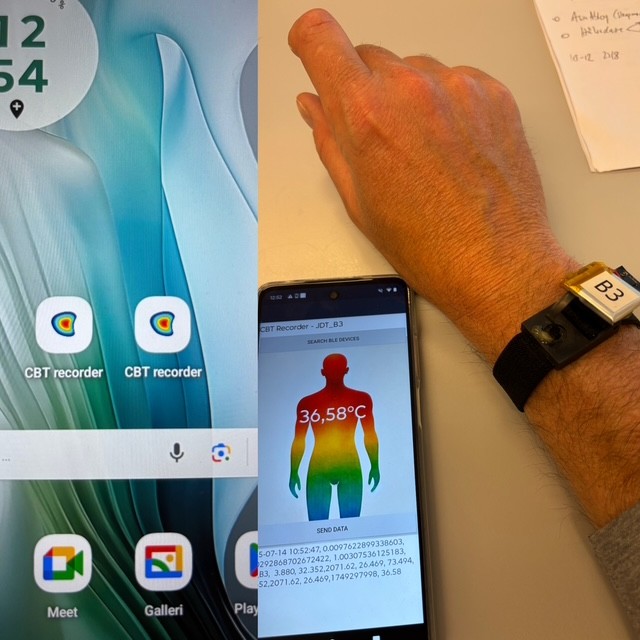

JonDeTech is a provider of sensor technology. The company markets a portfolio of IR sensor elements based on proprietary nanotechnology and silicon MEMS. The nano-elements are extremely thin, built in flexible plastic and can be manufactured in high volumes at a low cost, which opens up a variety of applications, such as temperature and heat flow measurements, presence detection and gas detection. The company is listed on Nasdaq First North Growth Market. Redeye is the company’s Certified Adviser. Read more at: www.jondetech.se or see how the IR sensor works at: https://www.youtube.com/watch?v=mORloeCxbPE&t=122s.