The prospectus relating to the rights issue in JonDeTech Sensors AB (publ) (“JonDeTech” or the “Company”) of approximately a maximum of MSEK 36.3 before issue costs has today on 28 August 2020 been approved and registered by the Swedish Financial Supervisory Authority. The prospectus is available on the Company’s website www.jondetech.se as well as on Hagberg & Aneborn’s website www.hagberganeborn.se.

On 10 August 2020, the extraordinary general meeting of JonDeTech resolved on a rights issue of 3,634,560 shares with preferential rights for the Company’s existing shareholders (the “Rights Issue“).[1] The subscription price in the Rights Issue is SEK 10.00 per share and will provide the Company with approximately a maximum of MSEK 36.3 before issue costs. Due to the Rights Issue, the board of directors has prepared a prospectus which today has been approved and registered by the Swedish Financial Supervisory Authority.

For full information regarding the the Rights Issue, please refer to the prepared prospectus available on the Company’s website www.jondetech.se as well as on Hagberg & Aneborn’s website www.hagberganeborn.se. The subscription period runs from 1 September to 15 September 2020.

Advisers

Naventus Corporate Finance is the financial advisor of the Company and Roschier is the legal advisor of the Company in connection with the Rights issue.

About Naventus Corporate Finance AB

Naventus Corporate Finance is an independent privately-held financial advisor offering services relating to qualified advice regarding IPOs, capital raises and M&A to listed and unlisted companies and their owners. www.naventus.com.

[1] The board of directors’ proposal to carry out a rights issue, resolved by the extraordinary general meeting on 10 August 2020 prescribed a maximum size to the rights issue with a possibility for the board to adjust the issue size slightly downwards in order to reach an appropriate number of shares, based on whether the private placement had been registered. The private placement was registered before the record date for participation in the rights issue and a minor downward adjustment of the total issue size in the rights issue has been made on this basis.

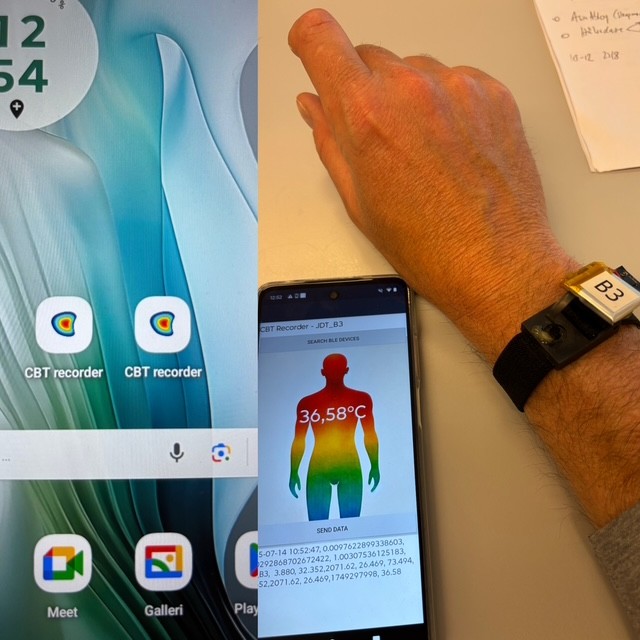

About JonDeTech JonDeTech is a Swedish company that develops, and markets patented IR sensor technology based on nanotechnology. The company’s IR sensors are down to one-tenth as thick as conventional sensors, built in plastic and can be manufactured in high volumes at a low cost, which opens for a variety of applications in, among other things, consumer electronics and mobile phones. The company was founded in 2008 and is listed on Nasdaq First North Growth Market. Redeye is the company’s Certified Adviser, +46-8-121 576 90, [email protected], https://www.redeye.se. Read more at www.jondetech.se or see how the IR sensor works at www.youtube.com/watch?v=2vEc3dRsDq8.

Important information

The information in this press release does not contain or constitute an offer to acquire, subscribe or otherwise trade in shares, subscription rights or other securities in the Company in any jurisdiction. Any invitation to the persons concerned to subscribe for shares in JonDeTech will only be made through the prospectus that JonDeTech plans to publish on or around 28 August 2020.

This press release may not be released, published or distributed, directly or indirectly, in or in Australia, Canada, Hong Kong, Japan, New Zealand, Singapore, the United States of America or any other jurisdiction where such action is wholly or partially subject to legal restrictions or where such action would require additional prospectuses, registrations or other actions in addition to what follows from Swedish law. Nor may the information in this press release be forwarded, reproduced or disclosed in a manner that contravenes such restrictions or would entail such requirements. Failure to comply with this instruction may result in a violation of applicable securities laws.

The securities referred to in this press release have not been and will not be registered under the United States Securities Act of 1933, as amended (“Securities Act”), or under the securities laws of any state or other jurisdiction in the United States and may not be offered, subscribed, used, pledged, sold, resold, allotted, delivered or transferred, directly or indirectly, in or into the United States absent exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in accordance with securities laws of the relevant state or other jurisdiction in the United States. All offers and sales of securities in connection with any rights offer by JonDeTech will be made, subject to certain limited exceptions, outside of the United States and in reliance on, and in compliance with, Regulation S under the Securities Act. There will be no public offering in the United States.

Within the European Economic Area (“EEA”), no public offering of securities is made in other countries than Sweden. In other member states of the EU, such an offering of securities may only be made in accordance with an applicable exemption in the Prospectus Regulation (EU) 2017/1129.

This press release contains certain forward-looking information that reflects the Company’s present view of future events as well as financial and operational development. Words such as “intend”, “assess”, “expect”, “may”, “plan”, “believe”, “estimate” and other expressions entailing indications or predictions of future development or trends, not based on historical facts, constitute forward-looking information. Forward-looking information is inherently associated with both known and unknown risks and uncertainties as it depends on future events and circumstances. Forward-looking information is not a guarantee of future results or development and actual outcomes may differ materially from the statements set forth in the forward-looking information.