The board of JonDeTech Sensors AB (publ) (“JonDeTech” or the “Company”) has today decided to propose an extraordinary general meeting to resolve on a directed share issue of approximately SEK 3 million to Wiser Unicorn Limited (“Directed Share Issue”). The subscription price is set at SEK 0.65 per share. The purpose of the Directed Share Issue is to enable continued commercialization and establishment in the Asian electronics market in a cost-effective manner. The extraordinary general meeting is planned to be held on March 2, 2023, and the notice will be published in a separate press release.

Directed Share Issue to Wiser Unicorn Limited

The Directed Issue comprises the issue of 4,615,384 shares at a subscription price of SEK 0.65 per share. The Company can thus add approximately SEK 3 million before issuing costs.

On February 9, 2023, the Company entered into a consultancy agreement with Wiser Unicorn Limited (“Wiser Unicorn”) regarding the purchase of consulting services related to the commercialization and marketing of the Company’s products and technology in Asia. In light of the consultancy agreement with Wiser Unicorn and the Company’s increased presence in the Asian electronics market, the Company will set aside approximately SEK 2.55 million of the issue proceeds for Wiser Unicorn’s continued commercialization and marketing efforts under the consultancy agreement. The reason for deviating from the shareholders’ preferential right is thus to strengthen the Company’s financial as well as operational position with an investment from a strategic player who can offer the Company good cooperation and growth opportunities. Furthermore, the Directed Share Issue enables the Company to be provided with financing quickly and efficiently, not least as the costs are significantly lower than in the case of a customary rights issue.

The subscription price has been determined through negotiations at arm’s length between the parties. It represents a premium of approximately 48.74 percent in relation to the closing price of the Company’s share on the Nasdaq First North Growth Market on February 10, 2023. The Board considers that the terms of the Directed Share Issue are in line with fair market value, not least because no discount is given in the Directed Share Issue, but rather that it is proposed to be carried out with a premium in relation to the market price. Overall, the Board believes that the Directed Share Issue constitutes an essential step in increasing and enabling the Company’s continued commercialization and establishment on the Asian market, thereby creating value for all the Company’s shareholders.

As Wiser Unicorn is controlled by the Company’s board member Dave Wu, the Directed Share Issue is covered by Chapter. 16 of the Swedish Companies Act, the so-called Leo Act, and will thus be presented for resolution at the extraordinary general meeting.

Number of shares and share capital

Through the Directed Share Issue, the number of shares in the Company can increase by 4,615,384 from 89,912,251 to 94,527,635. The share capital can increase by SEK 176,388.595134, from SEK 3,436,224.513430 to SEK 3,612,613.108569.

Extraordinary general meeting

The extraordinary general meeting is planned to take place on March 2, 2023. The notice of the extraordinary general meeting will be published through a separate press release.

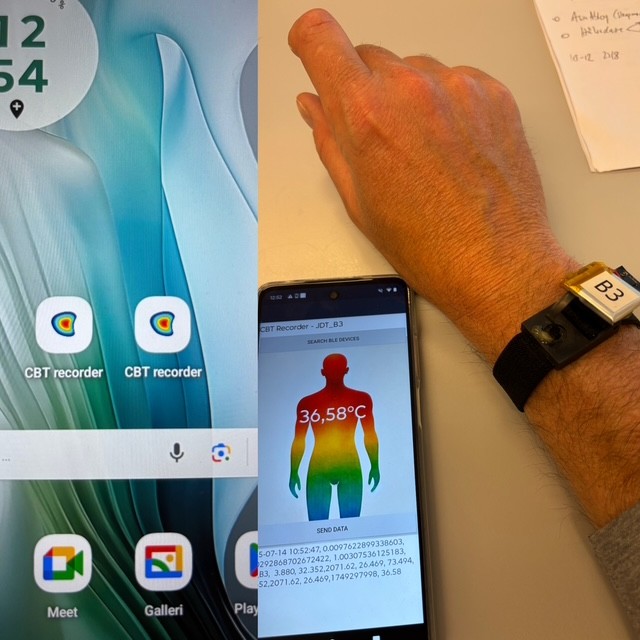

About JonDeTech

JonDeTech is a provider of sensor technology. The company markets a portfolio of IR sensor elements based on proprietary nanotechnology as well as on silicon MEMS. The nano-elements are extremely thin, built in flexible plastic and can be manufactured in high volumes at low cost, opening up a variety of applications, such as temperature and heat flow measurements, presence detection and gas detection. The company is listed on the Nasdaq First North Growth Market. Redeye is the company’s Certified Adviser. Read more at: www.jondetech.se or see how the IR sensor works at: https://www.youtube.com/watch?v=mORloeCxbPE&t=122s.