The Board of JonDeTech Sensors AB (publ) has signed a so-called term sheet with the Chinese fund Jiuyou Equity Investment Fund Management Co. Ltd and accordingly today decided to carry out a direct share issue of SEK 40 million, corresponding to 2,932,552 shares at a subscription price of SEK 13.64 per share. The subscription is, among other things, subject to a due diligence process. The subscription period runs until April 30, 2020, and the finalized transaction will result in dilution of existing shares corresponding to approximately 13,9 percent.

The reason for conducting a transaction that deviates from the shareholders’ preferential rights is, according to the Board of JonDeTech, the instrumental role Jiuyou Fund will be able to play for the company in the Asian markets. Besides being a financially stable owner with a long-term belief in the company, Jiuyou Fund will be able to give access to relevant local stakeholders and a platform for value creation. The company will primarily use the capital to (i) develop the company’s Go-To-Market strategy, (ii) strengthen the company’s presence in Asia, (iii) develop the company’s manufacturing capacity, (iv) strengthen the company’s product portfolio, (v) strengthen the organization as well as (vi) new patents. The subscription price is calculated as 95 percent of the average share price based on turnover and closing price 60 days prior to March 10, 2020, rounded to two decimals. The Board believes that the subscription price is well in line with the current market conditions.

Jiuyou Fund is not obliged to subscribe to the shares and complete the investment, even if it is the intention and hope of the parties that this will happen. The investment is conditional on, among other things, that Jiuyou Funds obtain relevant permits and decisions for the investment, that the investment is compliant with applicable Chinese law, and that Jiuyou Funds can conduct a due diligence investigation. Therefore, there is no guarantee that the investment will be made. However, the parties expect the transaction to be completed by April 30, 2020. Upon completion of the transaction with the above conditions, the outstanding shares in the company will increase from 18,121,000 to 21,053,552, which corresponds to a dilution of approximately 13.9 percent. The issue of new shares will take place by the authorization granted by the Annual General Meeting on May 27, 2019.

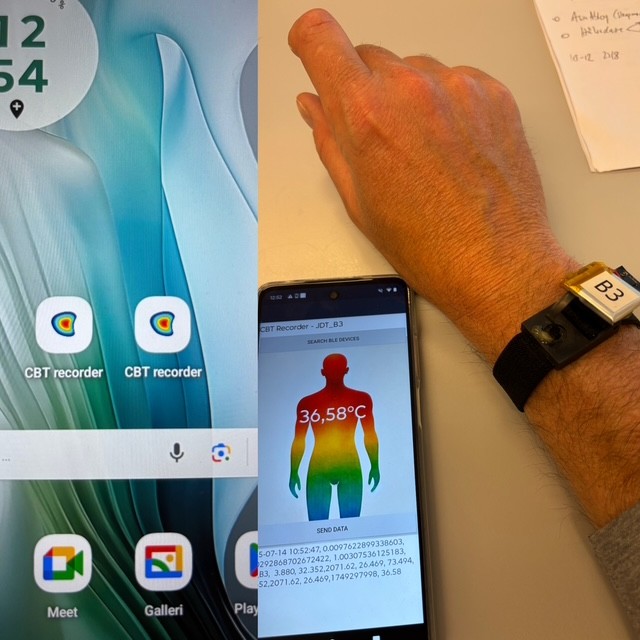

JonDeTech is a Swedish company that develops, and markets patented IR sensor technology based on nanotechnology. The company’s IR sensors are down to one-tenth as thick as conventional sensors, built in plastic and can be manufactured in high volumes at a low cost, which opens for a variety of applications in, among other things, consumer electronics and mobile phones. The company was founded in 2008 and is listed on Nasdaq First North Growth Market. Redeye is the company’s Certified Adviser, +46-8-121 576 90, [email protected], https://www.redeye.se. Read more at www.jondetech.se or see how the IR sensor works at www.youtube.com/watch?v=2vEc3dRsDq8.