JonDeTech Sensors AB (publ) (“JonDeTech” or the “Company”) announces today that the board of directors has resolved to carry out a 100% underwritten rights issue of MSEK 36.45 as well as to carry out a directed share issue of MSEK 18.45. Both share issues are carried out at a subscription price of SEK 10.00 per share. The rights issue requires approval by an extraordinary general meeting, which is planned to be held on 10 August 2020.

Background and reasons

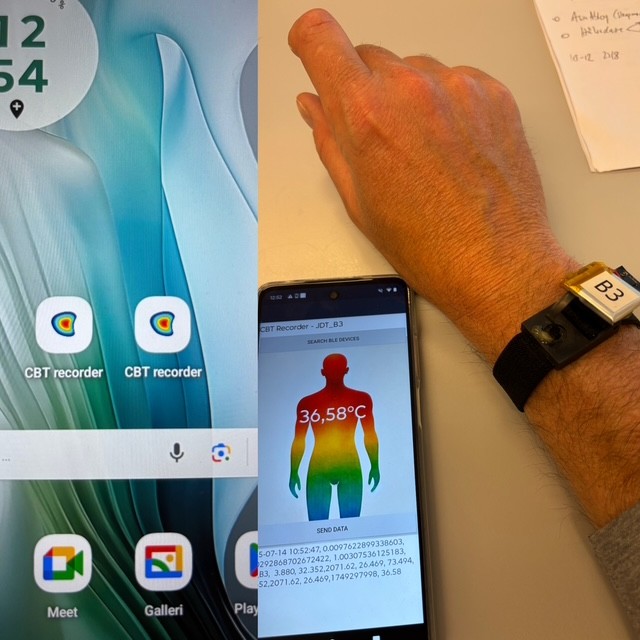

In 2019, JonDeTech launched a new focused Go-To-Market strategy with the aim to reach market acceptance with some of the world’s largest and most successful Original Design Manufacturers (ODMs) and component manufacturers. This strategy has resulted in three different development projects with one of the world’s largest ODMs, OFILM. The cooperations within biometric locks, temperature measurement using mobile phones and presence detection via laptop computers constitute, each individually as well as jointly, great opportunities for JonDeTech to reach a strong position within the high volume market for consumer electronics.

The rights issue and the directed issue are carried out with the purpose of creating financial space and conditions to implement the Company’s growth potential and in the long term to create value for the shareholders. The Company intends to primarily use the funds to (i) further develop the Company’s Go-To-Market strategy, (ii) strengthen the Company’s presence in Asia, (iii) develop the Company’s manufacturing capacity and (iv) strengthen the Company’s product portfolio, (v) strengthen the organisation and (vi) new patents.

Terms and conditions of the share issues

The board of directors of JonDeTech has resolved to within short issue a notice to convene an extraordinary general meeting to be held on 10 August 2020 and to propose the extraordinary general meeting to resolve to issue no more than 3,645,166 shares with preferential rights for existing shareholders. Detailed terms of the rights issue will be included in the notice to the extraordinary general meeting as well as in the prospectus expected to be published on 28 August 2020.

Further, the board of directors has, based on the authorization of the annual general meeting held on 26 May 2020, resolved to carry out a share issue of no more than 1,845,000 shares directed to a limited number of professional and institutional investors at the same subscription price as in the rights issue, i.e. at a subscription price of SEK 10.00 per share. The reason for deviating from the preferential right of the shareholders is to provide fast and cost-efficient funding to the Company.

The rights issue is expected to increase the Company’s share capital with no more than SEK 139,309,26 through issuing of no more than 3,645,166 shares and the directed share issue will increase the Company’s share capital with no more than SEK 70,511.35 through the issue of no more than 1,845,000 shares. The share capital of the Company is expected to increase in total with no more than SEK 209,820.61 through the issuing of no more than 5,490,166 shares, which corresponds to approximately 21% of outstanding shares after the share issues. The combined share issues are expected to provide MSEK 54.90 in total to the Company (before costs related to the transactions).

The subscription price is determined at SEK 10,00 per share, which represents a discount of approximately 20.3% compared to the closing price of the share on First North on 17 July 2020, the last day of trading before the resolution to carry out the share issues.

The terms and conditions as well as the price in the share issues and underwriting undertakings have been determined based on negotiations with investors and the terms which the board of directors considers that the transactions can be carried out on in view of current market conditions.

Underwriting undertakings and lock-up undertakings

A number of the subscribers in the directed share issue has entered into agreements to subscribe for shares not otherwise subscribed for in the rights issue, up to an amount of SEK 36,451,660, meaning that 100% of the rights issue is covered by underwriting undertakings. Additionally, the subscribers have committed not to sell their shares prior to the rights issue and to support the rights issue at the extraordinary general meeting (further details will be provided in connection with the notice to the extraordinary general meeting).

Commission for the underwriting undertakings (no commission will be paid for any shares subscribed for with preferential rights) shall either be received as (i) a cash amount corresponding to 10% of the amount covered by the underwriting undertaking or (ii) in the form of shares corresponding to 12% of the number of shares covered by the underwriting undertaking. The underwriters have the right to choose which type of commission they shall receive, provided however, that the shares under the share-based alternative must be permissible under an authorisation to issue shares available to the board of directors at the relevant time (if not, the underwriters will automatically receive the cash alternative). The board of directors has, with the purpose of enabling the share-based alternative, resolved to propose that the extraordinary general meeting resolves to adopt a new issue authorization for the board of directors, which shall correspond to the issue authorization approved by the annual general meeting on 26 May 2020.

Prospectus

Full information relating to the rights issue will be included in the prospectus which is intended to be published on or around 28 August 2020.

Preliminary timetable for the rights issue

· 10 August Extraordinary General Meeting

· 28 August Record date for participation in rights issue

· 28 August Publication of prospectus

· 1-15 September Subscription period

Further details relating to the timetable will be communicated in connection with the issuing of notice to convene the extraordinary general meeting.

Advisers

Naventus Corporate Finance is the financial advisor of the Company and Roschier is the legal advisor of the Company in connection with the share issues.

About Naventus Corporate Finance AB

Naventus Corporate Finance is an independent privately-held financial advisor offering services relating to qualified advice regarding IPOs, capital raises and M&A to listed and unlisted companies and their owners. www.naventus.com

This information is information that JonDeTech Sensors AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out above, at 01.00 CEST on 20 July 2020.

About JonDeTech

JonDeTech is a Swedish company that develops, and markets patented IR sensor technology based on nanotechnology. The company’s IR sensors are down to one-tenth as thick as conventional sensors, built in plastic and can be manufactured in high volumes at a low cost, which opens for a variety of applications in, among other things, consumer electronics and mobile phones. The company was founded in 2008 and is listed on Nasdaq First North Growth Market. Redeye is the company’s Certified Adviser, +46-8-121 576 90, [email protected], https://www.redeye.se. Read more at www.jondetech.se or see how the IR sensor works at www.youtube.com/watch?v=2vEc3dRsDq8.

Important information

The information in this press release does not contain or constitute an offer to acquire, subscribe or otherwise trade in shares, subscription rights or other securities in the Company in any jurisdiction. Any invitation to the persons concerned to subscribe for shares in JonDeTech will only be made through the prospectus that JonDeTech plans to publish on or around 28 August 2020.

This press release may not be released, published or distributed, directly or indirectly, in or in Australia, Canada, Hong Kong, Japan, New Zealand, Singapore, the United States of America or any other jurisdiction where such action is wholly or partially subject to legal restrictions or where such action would require additional prospectuses, registrations or other actions in addition to what follows from Swedish law. Nor may the information in this press release be forwarded, reproduced or disclosed in a manner that contravenes such restrictions or would entail such requirements. Failure to comply with this instruction may result in a violation of applicable securities laws.

The securities referred to in this press release have not been and will not be registered under the United States Securities Act of 1933, as amended (“Securities Act”), or under the securities laws of any state or other jurisdiction in the United States and may not be offered, subscribed, used, pledged, sold, resold, allotted, delivered or transferred, directly or indirectly, in or into the United States absent exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in accordance with securities laws of the relevant state or other jurisdiction in the United States. All offers and sales of securities in connection with any rights offer by the Company will be made, subject to certain limited exceptions, outside of the United States and in reliance on, and in compliance with, Regulation S under the Securities Act. There will be no public offering in the United States.

Within the European Economic Area (“EEA”), no public offering of securities is made in other countries than Sweden. In other member states of the EU, such an offering of securities may only be made in accordance with an applicable exemption in the Prospectus Regulation (EU) 2017/1129.

This press release contains certain forward-looking information that reflects the Company’s present view of future events as well as financial and operational development. Words such as “intend”, “assess”, “expect”, “may”, “plan”, “believe”, “estimate” and other expressions entailing indications or predictions of future development or trends, not based on historical facts, constitute forward-looking information. Forward-looking information is inherently associated with both known and unknown risks and uncertainties as it depends on future events and circumstances. Forward-looking information is not a guarantee of future results or development and actual outcomes may differ materially from the statements set forth in the forward-looking information.