An extraordinary general meeting in JonDeTech Sensors AB (publ), reg. no. 556951-8532 (the “Company“), was held on Monday 16 October 2023 at the premises of Eversheds Sutherland Advokatbyrå in Stockholm. The meeting resolved, inter alia, on the following:

Resolution on share capital reduction (number 1)

It was resolved to reduce the Company’s share capital by SEK 4,698,872.538079 for allocation to unrestricted equity and without cancellation of shares. After the reduction in accordance with the proposal, the Company’s share capital will amount to SEK 875,089.794, divided into 145,848,299 shares (before the rights issue), each share with a quota value of SEK 0.006.

Resolution on amendment of the articles of association

It was resolved that the limits of the articles of association for the share capital and the number of shares should be amended as set out below. In case the share capital and the number of shares in the Company, after registration of the first reduction of the share capital and the rights issue, fall below the new limits in the articles of association, the limits shall be lowered to the extent required to enable registration.

4 § Share Capital

|

Current Wording |

Proposed Wording |

|

The share capital amounts to a minimum of SEK 3,400,000 and a maximum of SEK 13,600,000 |

The share capital amounts to a minimum of SEK 5,500,000 and a maximum of SEK 22,000,000. |

- 5 Number of shares

|

Current Wording |

Proposed Wording |

|

The number of shares shall be not less than 89,000,000 and not more than 356,000,000. |

The number of shares shall be not less than 900,000,000 and not more than 3,600,000,000. |

Approval of the Board of Directors’ decision on the preferential issue of units from 13 September 2023

It was decided to approve the board’s decision from 13 September 2023 to issue a maximum of 145,848,299 units, containing seven (7) shares, seven (7) warrants of series TO2 and seven (7) warrants of series TO3, with preferential rights for existing shareholders. The subscription price amounts to SEK 0.28 per unit, corresponding to SEK 0.04 per share. Shareholders who are registered in the share register kept by Euroclear Sweden AB on the record date of 18 October 2023 receive unit rights for participation in the issue. The right to subscribe for units is with preferential rights to those who are registered as shareholders in the Company on the record date for the issue, whereby holding one (1) share entitles to one (1) unit right. One (1) unit right entitles the holder to subscribe for one (1) unit.

Each warrant of series TO2 entitles the holder to subscribe for one (1) share at a subscription price corresponding to 70 per cent of the volume-weighted average price of the Company’s share on Nasdaq Frist North Growth Market from 27 December 2023 to 10 January 2024, however, not less than the share’s quota value and not more than SEK 0.05. Subscription of new shares can be made during the period from 12 January 2024 up to and including 26 January 2024.

Each warrant of series TO3 entitles the holder to subscribe for one (1) share at a subscription price corresponding to 70 percent of the volume-weighted average price of the Company’s share on Nasdaq Frist North Growth Market from 17 September 2024 up to and including 30 September 2024, but not less than the share’s quota value and not more than SEK 0.06. New subscription of shares can be made during the period from 2 October 2024 up to and including 16 October 2024.

Resolution on share capital reduction (number 2)

It was resolved to reduce the Company’s share capital by a maximum of SEK 1,426,756.019921 for allocation to unrestricted equity and without cancellation of shares. The share capital reduction shall be set to an amount in SEK corresponding to the part of the share capital increase according to the resolution on the rights issue above minus the amount of the reduction according to the share capital reduction above, with relevant adjustments to achieve an appropriate quota value. The reduction is carried out without cancellation of shares through the change in quota value of the shares.

For more information, please contact:

Dean Tosic, CEO JonDeTech, phone: +46 73 994 85 70, mail: [email protected]

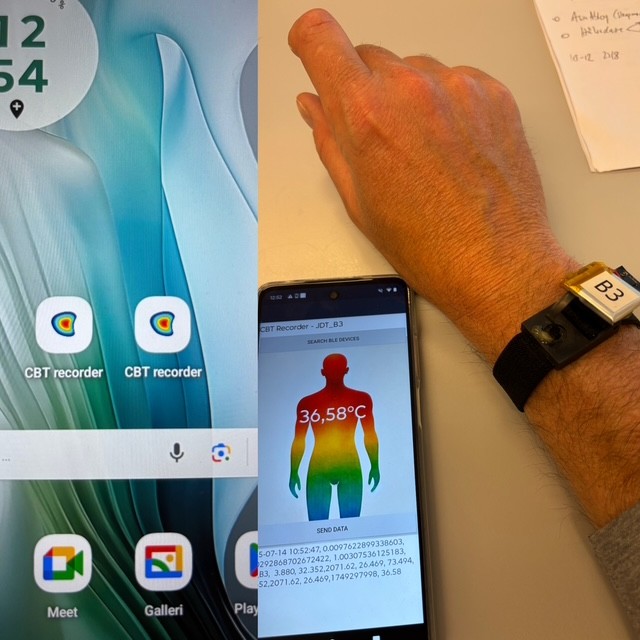

About JonDeTech

JonDeTech is a supplier of sensor technology. The company markets a portfolio of IR sensor elements based on proprietary nanotechnology and silicon MEMS. The nanoelements are extremely thin, built-in flexible plastic, and can be manufactured in high volumes at a low cost, which opens up for a variety of applications, such as temperature and heat flow measurements, presence detection, and gas detection. The company is listed on Nasdaq First North Growth Market. Redeye is the company’s Certified Adviser. Read more at www.jondetech.se or see how the IR sensor works at www.youtube.com/watch?v=2vEc3dRsDq8.