An extraordinary general meeting in JonDeTech Sensors AB (publ), reg. no. 556951-8532 (the “Company“), was held on Monday, 10 August 2020 by way of postal voting procedure. The resolutions passed by the extraordinary general meeting were, inter alia, the following:

Resolution on a rights issue

In accordance with the board of directors’ proposal, the general meeting resolved to carry out a rights issue of no more than 3,645,166 shares, entailing an increase in the share capital of not more than SEK 139,309.25570.

As per the record date on 28 August 2020, every existing share entitles the holder to four (4) subscription rights. Twenty-five (25) subscription rights entitle to subscription of one (1) new share. It is noted that 1,845,000 shares in the Company, pursuant to a separate resolution by the board of directors on 19 July 2020, have been issued and that all of said shares are expected to be subscribed for, registered and entered into the share register kept by Euroclear Sweden AB before the record date. All of said shares are hence expected to be entitled to participate in the rights issue. It is noted that if the issue is fully subscribed using the ratio 4:25 as per the foregoing, the issue will comprise no more than 3,634,560 shares, entailing an increase in the share capital of no more than SEK 138,903.92053.

If 1,000,000 shares of the above-mentioned 1,845,000 shares have been subscribed for, registered and entered into the share register kept by Euroclear Sweden AB before the record date, the number of subscription rights that each share entitle to shall be adjusted to one (1) subscription right and the number of subscription rights required for subscription of each one (1) new share in the Company shall be adjusted to six (6), entailing that the number of shares issued shall be no more than 3,645,166 shares, entailing an increase in the share capital of not more than SEK 139,309.25570.

If none of the above-mentioned 1,845,000 shares have been subscribed for, registered and entered into the share register kept by Euroclear Sweden AB before the record date, the number of subscription rights that each share entitle to shall be adjusted to one (1) subscription right and the number of subscription rights required for subscription of each one (1) new share in the Company shall be adjusted to six (6), entailing that the number of shares issued shall be no more than 3,478,500 shares, entailing an increase in the share capital of not more than SEK 132,939.69217.

A subscription price of SEK 10.00 shall be paid for each share subscribed for. Subscription for new shares with subscription rights shall take place through payment for the newly-issued shares during the period 1 – 15 September 2020. Subscription for new shares without subscription rights shall be done during the same period. Subscription shall, in such case, be carried out on a separate subscription list. Cash payment for shares which have been subscribed for without subscription rights shall be carried out in accordance with separate instructions provided in a transfer note, however no later than three banking days after the issuing of the transfer note. Subscription for new shares without subscription rights by persons who have underwritten the share issue shall be carried out using a separate subscription list no later than 18 September 2020. Cash payment for shares subscribed for without subscription rights by those who have underwritten the share issue pursuant to a separate agreement with the Company shall be made in accordance with the instructions in said agreements, however, no later than three banking days after payment request. The board of directors shall be entitled to extend the subscription and payment period.

Further information about the rights issue will be included in the prospectus expected to be published on around 28 August 2020.

Resolution on an authorisation for the board to resolve on a new share issue

In accordance with the board of directors’ proposal, the general meeting resolved to authorise the board to, on one or more occasions, for the period until the next annual general meeting, issue no more than 436,147 shares, either applying or disapplying shareholders’ pre-emption rights. A decision to issue shares under the authorisation may include a provision on payment by way of non-cash consideration, set-off or cash. The authorisation shall apply in parallel with the authorisation granted by the annual general meeting on 26 May 2020.

The purpose of the authorisation and the reason for deviation from the shareholders’ pre-emption rights is to, through share issues, enable share-based compensation under undwriting agreements between the Company and the underwriters in the rights issue. The issues shall be made on market terms. The board of directors shall have the right to determine other terms and conditions for issues carried out under the authorisation, as well as who shall have the right to subscribe for the shares.

More information about the resolutions is available in the notice and the complete proposals comprised therein which are available on the Company’s website, www.jondetech.se.

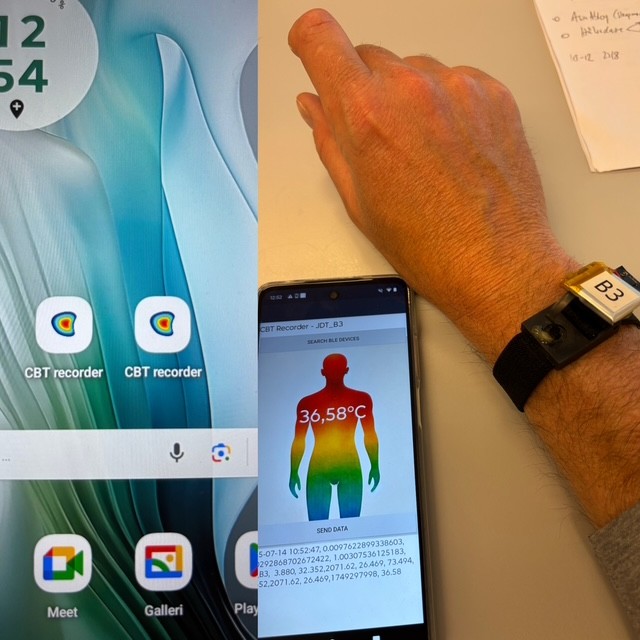

About JonDeTech JonDeTech is a Swedish company that develops, and markets patented IR sensor technology based on nanotechnology. The company’s IR sensors are down to one-tenth as thick as conventional sensors, built in plastic and can be manufactured in high volumes at a low cost, which opens for a variety of applications in, among other things, consumer electronics and mobile phones. The company was founded in 2008 and is listed on Nasdaq First North Growth Market. Redeye is the company’s Certified Adviser, +46-8-121 576 90, [email protected], https://www.redeye.se. Read more at www.jondetech.se or see how the IR sensor works at www.youtube.com/watch?v=2vEc3dRsDq8.