JonDeTech Sensors AB (publ) (“JonDeTech” or the “Company”) announced today that it has received subscription commitments and top underwriting commitments totaling approximately SEK 16.45 million, corresponding to approximately 61.67 percent of the issue proceeds that the Company could raise through the exercise of warrants of series TO3 (the “Warrants”). The subscription commitments amount to approximately SEK 3.12 million, corresponding to 11.68 percent of the Warrants, and have been provided by the Company’s CEO, Leif Borg, the Company’s Chairman of the Board, Jan Johannesson, and a number of major warrant holders. The top underwriting commitments amount to approximately SEK 13.34 million, corresponding to about 50 percent of the Warrants, and consist of a so-called top-down underwriting, which will be engaged if the Warrants are not exercised up to 100 percent. The top underwriting commitments have been entered into by a number of warrant holders who have entered into subscription commitments and by several external investors. The exercise period runs from October 2, 2024, to October 16, 2024.

The Company’s CEO, Leif Borg, the Company’s Chairman of the Board, Jan Johannesson, and several of the Company’s major warrant holders have provided subscription commitments totaling approximately SEK 3.12 million, corresponding to approximately 11.68 percent of the issue proceeds the Company could raise through the exercise of the Warrants. In addition, a number of warrant holders who have entered into subscription commitments, along with several external investors, have signed underwriting agreements totaling approximately SEK 13.34 million, corresponding to approximately 50 percent of the issue proceeds the Company could raise through the exercise of the Warrants. The underwriting commitments constitute a so-called top-down underwriting, meaning that if not all Warrants are exercised for the subscription of shares in the Company, the underwriting consortium will subscribe for shares through a directed new issue in the Company (the “Directed Issue“), equivalent to the number of shares that would otherwise have been issued if all Warrants had been exercised between approximately 50 and 100 percent.

The Board of Directors of JonDeTech intends to decide on the potential Directed Issue to the underwriting consortium, based on the authorization granted at the Annual General Meeting on May 3, 2024. In such a case, the subscription price in the Directed Issue will correspond to the exercise price for the Warrants, as per the underwriting agreement, i.e., SEK 2.95 per share. The Board of Directors will only decide on the Directed Issue if the Warrants are not exercised in full (100 percent). In such a case, the shares in the Directed Issue will be allocated pro rata among all underwriters in proportion to their respective underwritten amount. A decision on the Directed Issue, if applicable, will be announced through a separate press release.

The subscription commitments and underwriting undertakings have been agreed upon in writing and are not secured through primary transactions, bank guarantees, pledges, or similar. Compensation for the underwriting commitments has been set to either fifteen (15) percent of the underwritten amount paid out in in cash, or twenty (20) percent of the underwritten amount in newly issued shares. No compensation will be paid for the subscription commitments.

If all Warrants are exercised, the Company will raise approximately SEK 26.7 million, before issue costs. In order to prevent the Warrants from expiring worthless, holders must actively exercise the Warrants to subscribe for shares by no later than October 16, 2024, or alternatively, sell the Warrants no later than October 11, 2024. Please note that some nominees may close their application earlier than October 16, 2024.

The full terms of the Warrants are available on the Company’s website www.jondetech.com.

Summarized terms for the Warrants:

Exercise period: October 2, 2024 – October 16, 2024.

Exercise price: SEK 2.95 per share.

Issue size: 904,384,565 warrants of series TO3, which entitles to subscription of 9,043,845 shares. If all Warrants are exercised, the Company will receive approximately SEK 26.7 million, before issue costs.

Last day for trading for the Warrants: October 11, 2024.

Share capital and dilution: If all Warrants are exercised the share capital will increase with SEK 4,974,114.75 from SEK 9,388,424.65 to SEK 14,362,539.40. If all Warrants are exercised, the number of shares and votes in the Company will increase with 9,043,845 shares, from 17,069,863 shares to 26,113,708 shares. In the event that all Warrants are exercised, the dilution amounts to approximately 34.6 percent of the number of shares and votes in the Company.

Please note that warrants that are not exercised no later than October 16, 2024, or sold no later than October 11, 2024, will expire without value. For warrants not to lose their value, the holder must actively subscribe for new shares or sell the warrants.

How warrants are exercised:

Nominee-registered warrants (Custody account)

Subscription and payment by exercise of warrants shall be made in accordance with instructions from each nominee. Please contact your nominee for additional information.

Direct-registered warrants (Securities account)

No accounts for issuing nor any instructions regarding payments will be sent out. Subscriptions will be made through simultaneous payment in accordance with the instructions on the application form.

The warrants will then be replaced by interim shares awaiting registration at the Swedish Companies Registration Office.

The application form including instructions for payment will be available at JonDeTech’s website, www.jondetech.com, and on Mangold Fondkommission AB’s website, www.mangold.se.

Advisers

Mangold Fondkommission AB is financial adviser and Eversheds Sutherland Advokatbyrå is legal advisor for JonDeTech regarding the Warrants.

For further information about JonDeTech, please contact:

Leif Borg, CEO JonDeTech

Tel: +46 73 810 93 10

E-post: leif.borg@jondetech

About JonDeTech

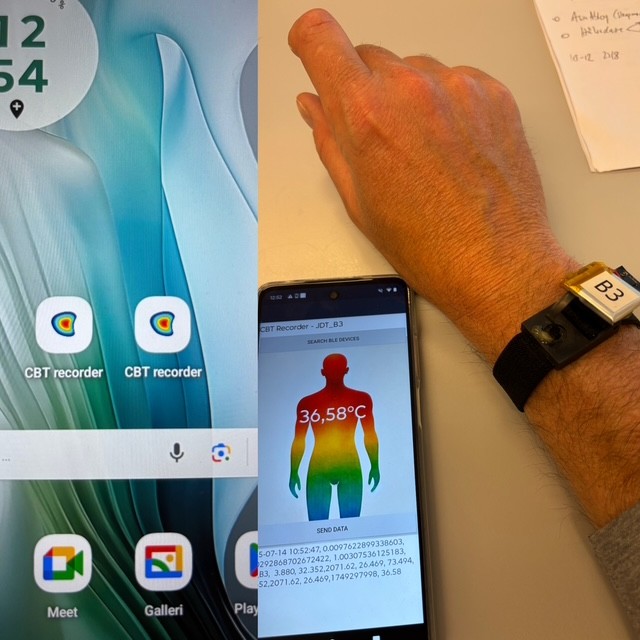

JonDeTech is a supplier of sensor technology. The company markets a portfolio of IR sensor elements based on proprietary nanotechnology and silicon MEMS. The nanoelements are extremely thin, built-in flexible plastic, and can be manufactured in high volumes at a low cost, which opens up for a variety of applications, such as temperature and heat flow measurements, presence detection, and gas detection. The company is listed on Nasdaq First North Growth Market. Mangold is the company’s Certified Adviser. Read more at: www.jondetech.com or see how the IR sensor works at : https://www.youtube.com/watch?v=mORloeCxbPE

This information is information that JonDeTech Sensors is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2024-10-09 08:30 CEST.