JonDeTech Sensors AB (publ) (the “Company” or “JonDeTech”) enters into an agreement with Wiser Unicorn Limited (“Wiser Unicorn”) regarding the commercialisation and marketing of the Company’s products to the Asian electronics market (the “Consultancy Agreement”). Furthermore, the board of directors of JonDeTech proposes an extraordinary general meeting to resolve on a directed share issue of 7,050,000 shares to Novel Unicorn Limited (“Novel Unicorn”) at a subscription price of SEK 0.50 per share (the “Directed Issue”). The Directed Issue is carried out in order to terminate a previous cooperation agreement and to enable the conclusion of the Consultancy Agreement. Both Wiser Unicorn and Novel Unicorn are controlled by board member Dave Wu, the Consultancy Agreement and the Directed Issue are therefore subject to approval and resolution by an extraordinary general meeting. Notice of the extraordinary general meeting will be published in a separate press release.

Background

With the production platform for the nanosensor on the brink of monetization and an expanding product portfolio with a combination of software, algorithms, and innovative hardware ready for market introduction, it is of utmost importance for JonDeTech to have access to the Asian markets.

As the current sales and marketing agreement with Novel Unicorn only covers JIRS30, it is the conviction of the board of directors that it is to the benefit of all shareholders to discontinue this agreement and replace it with a new one covering the full potential in JonDeTech’s current portfolio. Hence, Wiser Unicorn will be instrumental in JonDeTech’s go-to-market strategy. They will provide commercial services in Asia to support JonDeTech in addressing global customers based in the region. Compensation will be received as a success fee upon reaching milestones such as Design Wins or securing investor capital.

Consultancy Agreement with Wiser Unicorn

The Consultancy Agreement concerns the purchase of consulting services relating to the commercialisation and marketing of the Company’s products and technology in Asia. Under the agreement, Wiser Unicorn shall work towards finding new customers for the Company and to use its local expertise to help the Company and its subsidiaries enter into binding supply agreements with new customers, known as Design Wins. Furthermore, Wiser Unicorn will work towards finding new strategic investors for the Company.

The Consultancy Agreement will run for an initial period of three (3) years and will be renewed thereafter for periods of 12 months unless terminated by either party. Under the agreement, Wiser Unicorn is entitled to performance-based compensation of a maximum of MSEK 4 based on the delivery of work consisting of marketing and sales, securing design wins, and connecting JonDeTech to strategic investors and capital. The board considers the terms and conditions of the Consultancy Agreement to be in line with market conditions and to be beneficial for the Company’s long-term development and continued growth on the Asian markets.

In light of the fact that JonDeTech’s director Dave Wu controls the shares and votes in Wiser Unicorn, Wiser Unicorn is considered to be a related party to JonDeTech pursuant to Chapter 16a, Section 3 of the Swedish Companies Act. Pursuant to Chapter 16a of the Swedish Companies Act, material related party transactions must be submitted to a general meeting for approval. As of today’s date, the Consultancy Agreement has been signed, but is conditional on the approval of the shareholders of JonDeTech.

Directed Issue to Novel Unicorn

In connection with the conclusion of the Consultancy Agreement, the board of directors has proposed on the Directed Issue to Novel Unicorn. The purpose of the Directed Issue and the reason for the deviation from the shareholders’ preferential rights is to settle the termination of the cooperation agreement between the parties that was disclosed through press release on the 29 February 2020.

The Directed Issue comprises of 7,050,000 shares, issued at a subscription price of SEK 0.50 per share. The subscription price has been negotiated at arm’s length between the parties and represents a premium of approximately five (5) per cent to the closing price of the Company’s share on Nasdaq First North Growth Market on 8 February 2023. Given the volatility of the share in recent weeks, it is the overall assessment of the board of directors that the subscription price is in line with fair market value. Payment for the shares shall be made by way of a set-off of a claim. Overall, the board believes that the Directed Issue is an important step in enabling the Company’s continued growth and opportunities in the Asian markets, thereby creating value for all of the Company’s shareholders.

The Directed Issue is subject to Chapter 16 of the Companies Act, the so-called Leo Act, and will therefore be submitted for resolution at the extraordinary general meeting.

The Directed Issue will increase the number of shares in the Company 7,050,000 from 89,912,251. The share capital will increase by SEK 269,433,615 from SEK 3,436,224.513430 to SEK 3,705,658.12843.

Extraordinary general meeting

Notice to the extraordinary general meeting to approve the Consultancy Agreement and resolve on the Directed Issue will be published by separate press release. Prior to the extraordinary general meeting, the Company has obtained voting commitments from some of the major shareholders.

– As JonDeTech has evolved from production to commercialization and we now have several products in the portfolio, we have increased our focus on sales operations. The agreement with Wiser Unicorn will strongly contribute to the commercial success of JonDeTech since it will continue to enable us to reach the most important customers in the APAC region. The alternative, to build our own sales organization, would take considerably longer time and cost to achieve, says Dean Tosic, CEO JonDeTech.

– It has so far been a bumpy but progressing journey of the nanotech sensor development in JonDeTech. We are convinced that JonDeTech, through the years, has accumulated adequate knowledge and expertise around this sensing domain from both material and application prospectives and thus has been enabled to be further productized and capitalized. It is also time to adjust our cooperation going forward, as the company is vigorously expanding its market offerings while resharpening its focus towards a more market-oriented approach. We trust that this new arrangement will be beneficial to unleash JonDeTech’s technological accumulation and strength, aiming for a much broadened vertical. We are confident to work together under this new arrangement, to bring in more customer wins, to lift its in-sector visibility, and ultimately to create a better shareholder value, says Dave Wu, owner of Wiser Unicorn Limited.

About JonDeTech

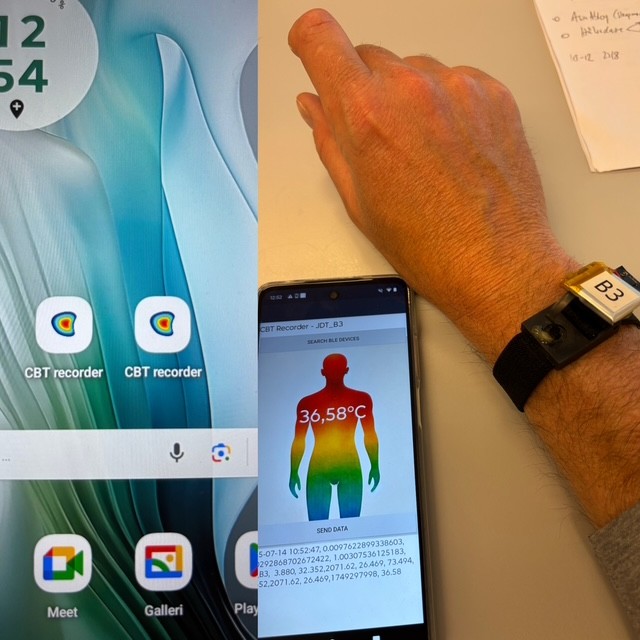

JonDeTech is a provider of sensor technology. The company markets a portfolio of IR sensor elements based on proprietary nanotechnology as well as on silicon MEMS. The nano-elements are extremely thin, built in flexible plastic and can be manufactured in high volumes at low cost, opening up a variety of applications, such as temperature and heat flow measurements, presence detection and gas detection. The company is listed on the Nasdaq First North Growth Market. Redeye is the company’s Certified Adviser. Read more at: www.jondetech.se or see how the IR sensor works at: https://www.youtube.com/watch?v=mORloeCxbPE&t=122s.