The Board of Directors of JonDeTech Sensors AB (publ) (“JonDeTech” or the “Company”) has today, subject to subsequent approval by an extraordinary general meeting, resolved on a rights issue of a maximum of 84,810,749 units consisting of shares and warrants with preferential rights for existing shareholders (the “Rights Issue”). Upon full subscription, the Company will receive proceeds of approximately SEK 42.4 million before issue costs. The Rights Issue is covered up to approximately 69 percent through subscription and guarantee commitments. The Rights Issue is carried out with the purpose of repaying loans, enable continued market launch activities to accelerate growth and to finance the development of the Company’s products. Notice of the extraordinary general meeting will be published in a separate press release. Further, the Company has entered into agreements for partial refinancing of the loans raised by the Company in February 2022.

The Rights Issue in brief

- Rights issue of a maximum of 84,810,749 units (84,810,749 shares and 84,810,749 warrants of series TO1) corresponding to, upon full subscription, total proceeds of approximately SEK 42.4 million before issue costs.

- Subscription commitments of approximately SEK 3.1 million in total and guarantee commitments of approximately SEK 26.0 million in total have been received in connection with the Rights Issue. The Rights Issue is thus covered to approximately 69 percent through subscription and guarantee commitments.

- For each existing share held on the record date, eight (8) unit rights are received in the Rights Issue. Holding of three (3) unit rights entitles to subscribe for one (1) new unit. One unit (1) consists of one (1) share and one (1) warrant.

- Subscription price of SEK 0.5 per unit (SEK 0.5 per share). The warrants are issued free of charge.

- The record date for the Rights Issue is 17 November 2022 with the last day for trading including the right to receive unit rights on 15 November 2022 and the first day for trading excluding the right to receive unit rights on 16 November 2022.

- The subscription period for the Rights Issue is expected to begin on 21 November 2022 and to end on 5 December 2022.

- The subscription price for subscription of shares by exercising warrants of series TO1 shall correspond to 70 percent of the volume-weighted average price of the Company’s share on Nasdaq First North Growth Market during a period of 10 trading days ending 27 January 2023 (end date included), but not more than 0.75 SEK per share and not less than the quota value of the share.

- The exercise period for warrants of series TO1 runs from and including 1 February 2023 to and including 15 February 2023.

CEO Dean Tosic, comments

“JonDeTech has entered an exciting phase, in which we have not only created a broader portfolio but also initiated several strategic partnerships. But foremost, we have succeeded with significant progress in the production of our proprietary sensor element.

This emission has been made possible by the great interest many investors have shown in our technology platform and we look forward to, with strengthened financials, move into a new phase and execute on our go-to market strategy during 2023.”

Background and reasons

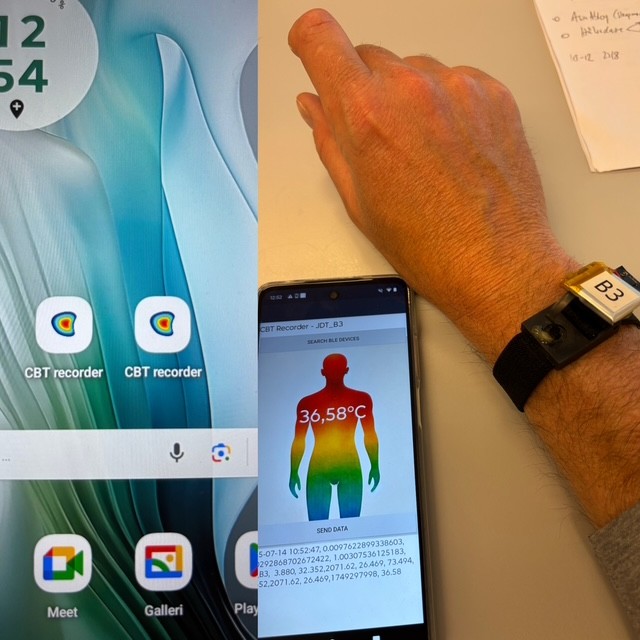

JonDeTech is developing a proprietary developed and patented sensor element architecture based on nanotechnology, JIRS30. In 2022 JonDeTech expanded its product portfolio with an in-house designed silicon-based IR sensor element, JIRS10. JonDeTech also offers services and software components to meet different customer needs.

The sensor element JIRS10, in combination with the Company’s services and software, is expected to generate revenues in the near-term compared to what an exclusive focus on JIRS30 would, since JIRS10 is already commercially available. Through establishment and sales of JIRS10, in combination with the Company’s services and software, the Company will build its sales and delivery processes. When JIRS30 is commercially available it will be distributed through the same sales and delivery processes.

JIRS10 and JIRS30 will be sold to large module houses, component manufacturers and product producing companies. This business model has earlier resulted in development projects with the module house Ofilm, which has indicated that JonDeTech has potential to establish a position within the volume market for consumer electronics, in particular within presence detection in biometric locks and personal computers for instance.

It is the Company’s assessment that the existing working capital is not sufficient to run the business over the next twelve months. With the purpose of repaying loans, enable continued market launch activities for growth and fund the development of the Company’s products, the Board of Directors resolved on 14 October 2022 to carry out the Rights Issue.

Terms of the Rights Issue

The Board of Directors of JonDeTech has resolved on the Rights Issue, subject to approval by an extraordinary general meeting, in accordance with the following principal terms:

- Rights issue of a maximum of 84,810,749 units (84,810,749 shares and 84,810,749 warrants of series TO1) corresponding to, upon full subscription, total proceeds of approximately SEK 42.4 million before issue costs.

- Subscription commitments of approximately SEK 3.1 million in total and guarantee commitments of approximately SEK 26.0 million in total have been received in connection to the Rights Issue. The Rights Issue is thus covered to approximately 69 percent through subscription and guarantee commitments.

- For each existing share held on the record date, eight (8) unit rights are received in the Rights Issue. Holding of three (3) unit rights entitles to subscribe for one (1) new unit. One unit (1) consists of one (1) share and one (1) warrant.

- Subscription price of SEK 0.5 per unit (SEK 0.5 per share). The warrants are issued free of charge.

- The record date for the Rights Issue is 17 November 2022 with the last day for trading including the right to receive unit rights on 15 November 2022 and the first day for trading excluding the right to receive unit rights on 16 November 2022.

- The subscription period for the Rights Issue is expected to begin on 21 November 2022 and to end on 5 December 2022.

- The subscription price for subscription of shares by exercising warrants of series TO1 shall correspond to 70 percent of the volume-weighted average price of the Company’s share on Nasdaq First North Growth Market during a period of 10 trading days ending 27 January 2023 (end date included), but not more than 0.75 SEK per share and not less than the quota value of the share.

- The exercise period for warrants of series TO1 runs from and including 1 February 2023 to and including 15 February 2023.

- The warrants of series TO1 are intended to be admitted to trading on the Nasdaq First North Growth Market after final registration with the Swedish Companies Registration Office regarding that the conditions for admission to trading, regarding among others, spread, are fulfilled.

- Through the Rights Issue, the share capital may increase by a maximum of SEK 3,241,257.687077 from SEK 1,215,471.637431 to SEK 4,456,729.324508 and the number of shares may increase by a maximum of 84,810,749 shares from 31,804,031 shares to 116,614,780 shares, corresponding to a dilution of approximately 72 percent of the total number of shares in the Company. Upon full exercise of the warrants, the share capital may increase by a maximum of SEK 3,241,257.687077 and the number of shares can increase by a maximum of 84,810,749. Upon full subscription and full exercise of all warrants in the Rights Issue, the dilution amounts to approximately 84.21 percent of the total number of shares in the Company.

- If not all units are subscribed for by exercise of unit rights, the Board shall, within the framework of the highest amount of the rights issue, resolve on the allocation of the units subscribed without the use of unit rights. Allocation shall then take place in the following order:

- Firstly, allotment shall be made to those who have also subscribed for units with the support of unit rights, regardless of whether the subscriber was a shareholder on the record date or not, and in the event of oversubscription in relation to the number of unit rights each used to subscribe for units and, to the extent that this cannot be done, by drawing lots.

- Secondly, allotment shall be made to others who have subscribed for units without the support of unit rights, and, in the event that they cannot receive full allotment, in proportion to the number of units each registered for subscription and, insofar as this is not can be done, by drawing lots.

- Lastly, any remaining units shall be allocated to the guarantors who have entered into guarantee commitments in relation to the size of the respective guarantee undertaking and, insofar as this cannot be done, by drawing lots.

Refinancing of loans

In February 2022, the Company raised debt financing for a total of SEK 22 million from a loan consortium consisting of private and professional investors, as announced by press release on 23 February 2022 (the “Loans”). The Loans were drawn down with an arrangement fee of 5 percent of the principal amount and a monthly interest rate of 1.25 percent.

In order to partially refinance the Loans, the Company has entered into supplemental agreements with the lenders to the effect that (i) SEK 11.5 million of the total loan amount, accrued interest as of 28 November 2022 and arrangement fee will be repaid/paid with the proceeds from the Rights Issue and (ii) payment of SEK 10.5 million of the loan amount will be extended up until and including 28 May 2023. The part of the Loans that is refinanced is subject to an arrangement fee of 5 percent of the principal amount. In the event that the warrants issued in the Rights Issue raise proceeds in excess of SEK 5 million, the excess amount shall be used for prepayment of the outstanding loan amount, pro rata in relation to the respective lender’s share of the total outstanding loan amount.

Shares and dilution

Through the Rights Issue, the share capital may increase by a maximum of SEK 3,241,257.687077 from SEK 1,215,471.637431 to SEK 4,456,729.324508 and the number of shares may increase by a maximum of 84,810,749 shares from 31,804,031 shares to 116,614,780 shares, corresponding to a dilution of approximately 72.72 percent of the total number of shares in the Company.

Upon full exercise of the warrants, the share capital may increase by a maximum of SEK 3,241,257.687077 from SEK 4,456,729.324508 to SEK 7,697,987.011585 and the number of shares can increase by a maximum of 84,810,749 shares from 116,614,780 shares to 201,425,529 shares. Upon full subscription and full exercise of all warrants in the Rights Issue, the dilution amounts to approximately 84.21 percent of the total number of shares in the Company.

Subscription and guarantee commitments

Subscription commitments of approximately SEK 3.1 million in total and guarantee commitments of approximately SEK 26.0 million in total have been received in connection to the Rights Issue. The Rights Issue is thus secured to approximately 69 percent through subscription and guarantee commitments.

No compensation is paid for the subscription commitments. The subscription commitments have not been secured by bank guarantee, blocked funds, pledges or similar arrangements. For the guarantee commitment, a guarantee fee of fourteen (14) percent of the guaranteed amount is payable in cash, alternatively sixteen (16) percent of the guaranteed amount through issuance of new units in the Company at a fair market subscription price.

Lock-up undertakings

In connection to the Rights Issue, Erik Hallberg (Chairman of the Board), Bengt Lindblad (Board Member), Jan Johannesson (Board Member), Magnus Eneström (Board Member), Dean Tosic (CEO) and Leif Borg (CCO) have undertaken towards Vator Securities AB, subject to customary exceptions, not to sell or otherwise transfer their shares without first, in each separate case, ascertain a written approval from Vator Securities AB. The decision to leave such written approval is decided by Vator Securities AB and the decision is made in each separate case. Agreed approval can depend on both individual and business-related situations. The lock-up period lasts for a period of 180 days from and including the date of expiration of the subscription period in the Rights Issue.

Prospectus

Complete terms and conditions regarding the Rights Issue as well as information on subscription commitments and further information about the Company will be presented in the prospectus which will be published by the Company prior to the commencement of the subscription period.

Preliminary timetable regarding the Rights Issue

|

16 November 2022 |

Extraordinary general meeting |

|

16 November 2022 |

Estimated date for publication of the prospectus |

|

15 November 2022 |

Last day of trading in units of the company including the right to receive unit rights |

|

16 November 2022 |

First trading day in the share excluding the right to receive unit rights |

|

17 November 2022 |

Record date regarding the Rights Issue |

|

21 – 30 November 2022 |

Trading in unit rights |

|

21 November 2022 – 5 December 2022 |

Subscription period for the Rights Issue |

|

Around 7 December 2022 |

Estimated date for publication of the Rights Issue results |

Advisors

Vator Securities AB acts as financial advisor and Eversheds Sutherland Advokatbyrå AB act as legal advisor in connection to the Rights Issue. Vator Securities AB also acts as issuer agent in connection to the Rights Issue.

About JonDeTech

JonDeTech is a Swedish company that develops, and markets patented IR sensor technology based on nanotechnology. The company’s IR sensors are down to one-tenth as thick as conventional sensors, built in plastic and can be manufactured in high volumes at a low cost, which opens for a variety of applications. The company is listed on Nasdaq First North Growth Market. Redeye is the company’s Certified Adviser, +46-8-121 576 90, [email protected], https://www.redeye.se.

Read more at www.jondetech.se or see how the IR sensor works at www.youtube.com/watch?v=2vEc3dRsDq8.

IMPORTANT INFORMATION

In certain jurisdictions, the publication, announcement or distribution of this press release may be subject to restrictions according to law. Persons in such jurisdictions where this press release has been published or distributed should inform themselves, observe and abide by such restrictions. The recipient of this press release is responsible for using this press release, and the information herein, in accordance with applicable rules in the respective jurisdiction. THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO, OR AN INVITATION TO, ACQUIRE OR SUBSCRIBE ANY SECURITIES IN THE COMPANY IN ANY JURISDICTION, NOT FROM THE COMPANY OR ANY OTHER PERSON.

This announcement is not a prospectus for the purposes of Regulation (EU) 2017/1129 (the “Prospectus Regulation”) and has not been approved by any regulatory authority in any jurisdiction. A PROSPECTUS, CORRESPONDING TO AN EU GROWTH PROSPECTUS, WILL BE PREPARED BY THE COMPANY AND PUBLISHED ON THE COMPANY’S WEBSITE AFTER THE PROSPECTUS HAS BEEN REVIEWED AND APPROVED BY THE SWEDISH FINANCIAL SUPERVISORY AUTHORITY.

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER OR INVITATION CONCERNING THE ACQUISITION OR SUBSCRIPTION OF SECURITIES IN THE UNITED STATES. THE SECURITIES REFERRED TO HEREIN MAY NOT BE SOLD IN THE UNITED STATES WITHOUT REGISTRATION, OR WITHOUT THE APPLICATION OF AN EXEMPTION FROM REGISTRATION, ACCORDING TO THE U.S. SECURITIES ACT FROM 1933 (“SECURITIES ACT”), AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES WITHOUT REGISTRATION, COVERED BY AN EXEMPTION FROM, OR IN A TRANSACTION NOT COVERED BY ACCOUNTS. THERE IS NO INTENT TO REGISTER ANY SECURITIES MENTIONED HEREIN IN THE UNITED STATES OR TO SUBMIT A PUBLIC OFFER REGARDING SUCH SECURITIES IN THE UNITED STATES. The information in this press release must not be published, published, copied, reproduced or distributed, directly or indirectly, in whole or in part, in or to the United States (including its territories and provinces, each state in the US and District of Columbia), Australia, Singapore, New Zeeland, Japan, South Korea, Canada, Hong Kong or South Africa or any other jurisdiction where such publication, publication or distribution of this information would be contrary to the applicable rules or where such a measure is subject to legal restrictions or would require further registration or other measures THAN WHAT FOLLOWS OF SWEDISH LAW. ACTIONS IN VIOLATION OF THIS INSTRUCTION MAY BREACH APPLICABLE SECURITIES LEGISLATION.

In the United Kingdom, this press release and any other materials in relation to the securities described herein is only being distributed to, and is only directed at, and any investment or investment activity to which this press release relates is available only to, and will be engaged in only with, “qualified investors” who are (i) persons having professional experience in matters relating to investments who fall within the definition of “investment professionals” in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); (ii) high net worth entities etc. falling within Article 49(2)(a) to (d) of the Order; or (iii) such other persons to whom such investment or investment activity may lawfully be made available under the Order (all such persons together being referred to as “relevant persons”). In the United Kingdom, any investment or investment activity to which this communication relates is available only to, and will be engaged in only with, relevant persons. Persons who are not relevant persons should not take any action on the basis of this press release and should not act or rely on it.

FORWARD-LOOKING STATEMENTS

TO THE EXTENT THIS PRESS RELEASE CONTAINS FORWARD-LOOKING STATEMENTS, SUCH STATEMENTS DO NOT REPRESENT FACTS AND ARE CHARACTERIZED BY WORDS THAT “WILL”, “ARE EXPECTED”, “BELIEVES”, “ESTIMATES”, “INTENDS”, “ASSUMES” AND SIMILAIR EXPRESSIONS. SUCH STATEMENTS EXPRESS JONDETECH’S INTENTIONS, OPINIONS OR CURRENT EXPECTATIONS OR ASSUMPTIONS. SUCH FUTURE STATEMENTS ARE BASED ON CURRENT PLANS, ESTIMATES AND FORECASTS WHICH JONDETECH HAS MADE TO THE BEST PERFORMANCE BUT WHICH JONDETECH DOES NOT SAY IN THE COMING TOMORROW. FUTURE STATEMENTS ARE COMBINED WITH RISKS AND UNCERTAINTIES THAT ARE DIFFICULT TO PREDICT AND IN GENERAL CANNOT BE AFFECTED BY JONDETECH. IT SHOULD BE KEEPED IN MIND THAT ACTUAL EVENTS OR OUTCOMES MAY DIFFER SIGNIFICANTLY FROM WHAT IS COVERED BY, OR EXPRESSED FOR, IN SUCH FORWARD-LOOKING STATEMENTS.

INFORMATION TO DISTRIBUTORS

Solely for the purposes of the product governance requirements contained within: (a) EU Directive 2014/65/EU on markets in financial instruments, as amended (“MiFID II”); (b) Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing measures (together, the “MiFID II Product Governance Requirements”), and disclaiming all and any liability, whether arising in tort, contract or otherwise, which any “manufacturer” (for the purposes of the MiFID II Product Governance Requirements) may otherwise have with respect thereto, the shares in JONDETECH have been subject to a product approval process, which has determined that such shares are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in MiFID II; and (ii) eligible for distribution through all distribution channels as are permitted by MiFID II (the “Target Market Assessment”). Notwithstanding the Target Market Assessment, Distributors should note that: the price of the shares in JONDETECH may decline and investors could lose all or part of their investment; the shares in JONDETECH offer no guaranteed income and no capital protection; and an investment in the shares IN JONDETECH is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom. The Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling restrictions in relation to the Share Issue. Furthermore, it is noted that, notwithstanding the Target Market Assessment, the Joint Bookrunners will only procure investors who meet the criteria of professional clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the shares in THE COMPANY.

Each distributor is responsible for undertaking its own target market assessment in respect of the shares in JONDETECH and determining appropriate distribution channels.