JonDeTech Sensors AB announces a correction regarding the press release “Notice to attend the Annual General Meeting in JonDeTech Sensors ab (publ)” which was published today, April 2, 2024 at 3:30 p.m. The correction concerns the contact details and description of the company that were omitted from the previous press release. The corrected press release in its entirety follows below.

Notice to attend the Annual General Meeting in JonDeTech Sensors ab (publ)

N.B. This English text is an unofficial translation of the Swedish original of the notice to attend the annual general meeting in JonDeTech Sensors AB (publ), and in case of any discrepancies between the Swedish and the English translation, the Swedish text shall prevail.

The shareholders in JonDeTech Sensors AB (publ), reg. no. 556951-8532 (the “Company“), are hereby convened to the annual general meeting on 3 May 2024 at 10.00 a.m. at Eversheds Sutherland Advokatbyrå’s premises at Sveavägen 20, 111 57 Stockholm. Registration starts at 09.45 am.

Right to participate and registration

Shareholders who wish to attend the general meeting shall

- be entered in the share register maintained by Euroclear Sweden AB on 24 April 2024, and;

- notify the Company of their attendance at the general meeting no later than 26 April 2024 by e-mail to [email protected] or by letter to Eversheds Sutherland Advokatbyrå AB, Att. Hanna Ullerholt, Box 14055, 104 40 Stockholm. In the notification, the shareholder shall state name, personal or corporate identity number, address, and telephone number and, where applicable, information about assistants (maximum 2).

INFORMATION ON POSTAL VOTING

The Company has, pursuant to § 11 of the articles of association, decided that the shareholders shall be able to exercise their voting rights by post before the meeting. Forms for postal voting will be available on the Company’s website (www.jondetech.se) no later than three weeks before the meeting. The completed and signed form should be sent by e-mail to [email protected]. The complete form must be received by the Company no later than 26 April 2024. Further instructions are included in the form. Please note that registration of shares in own name (if the shares are nominee-registered) and notification to the meeting must have been made even if the shareholder chooses to vote by post or by proxy.

NOMINEE REGISTERED SHARES

Shareholders whose shares are registered in the name of a nominee through a bank or securities institution must register their shares in their own name in order to be entitled to participate in the Annual General Meeting. Such registration may be temporary (so-called voting rights registration) and is requested from the nominee according to the nominee’s procedures. Voting rights registrations completed (registered with Euroclear Sweden AB) no later than 26 April 2024 are taken into account in the preparation of the share register.

PROXY

Shareholders who are represented by proxy shall issue a written power of attorney for the proxy, signed and dated by the shareholder. The period of validity of the proxy may not exceed five years if specifically stated. If no period of validity is specified, the proxy is valid for a maximum of one year. If the proxy is issued by a legal person, a copy of the registration certificate or equivalent for the legal person must be attached. The original power of attorney and any certificate of registration should be sent by post to the Company at the above address well in advance of the meeting. The proxy form is available on the Company’s website (www.jondetech.se) no later than three weeks before the meeting.

Proposed AGENDA

- Opening of the meeting

- Election of the chairman of the meeting

- Approval of the agenda

- Preparation and approval of the voting list

- Election of one or two persons to verify the minutes

- Determination of whether the meeting has been duly convened

- Presentation of the annual report and the auditor’s report and the consolidated financial statements and the auditor’s report on the consolidated financial statements

- Statement by the chief executive officer

- Resolution on:

- adoption of the income statement, balance sheet and consolidated income statement and balance sheet

- allocation of the Company’s profit or loss according to the adopted balance sheet

- discharge from liability for the members of the board of directors and the chief executive officer

- Determination of the remuneration to the board of directors and auditor

- Election of the board of directors, chairman of the board and auditor

- Resolution on a) amendment of the Articles of Association (number of shares), b) directed share issue (equalisation issue) and c) reverse share

- Proposal for resolution on a) implementation of the Incentive Programme 2024/2027A to the Company’s CEO, other key employees and certain other employees and consultants in the Company, b) directed issue of warrants and c) approval of transfer of warrants

- Proposal for resolution on a) implementation of the Incentive Programme 2024/2027B to the members of the Board of Directors, b) directed issue of warrants and c) approval of transfer of warrants

- Resolution authorising the board of directors to decide on issues of shares, warrants and convertibles

- Resolution to authorise the board of directors to make minor adjustments to the resolutions adopted by the general meeting

- Closure of the meeting

PROPOSAL FOR A DECISION

Item 2 – Election of the chairman of the meeting

The board of directors proposes that Johan Engström, lawyer at Eversheds Sutherland Advokatbyrå AB, is appointed as chairman of the meeting.

Item 4 – Preparation and approval of the voting list

The voting list proposed for approval is the voting list that will be drawn up on the basis of the share register and the notifications and postal votes received, which have been checked and approved by the person responsible for verifying the minutes.

Item 9b – Resolution on allocation of the Company’s profit or loss according to the adopted balance sheet.

The board of directors proposes that no dividend is paid and that the financial result for the year is carried forward.

Item 10 – Determination of the remuneration to the board of directors and auditor

The board of directors proposes that remuneration to each of the board members, with the exception of the chairman of the board, shall be paid with SEK 150,000 per year. Furthermore, it is proposed that remuneration to the chairman of the board of directors shall be paid with SEK 420,000 per year. The auditor’s fee is proposed to be paid according to current account.

Item 11 – Election of the board of directors, chairman of the board and auditor

The board of directors proposes the re-election of Bengt Lindblad, Magnus Eneström, Dave Qun Wu, Jan Johannesson and Karl Lundahl as members of the Board. Jan Johannesson is proposed as Chairman of the Board.

The board of directors proposes that the registered accounting firm Öhrlings PricewaterhouseCoopers AB is elected as auditor for the period until the end of the next annual general meeting with Per Andersson as auditor in charge.

Item 12 – Resolution on (a) amendment of the Articles of Association (number of shares), (b) directed share issue (equalisation issue) and (c) reverse share split

In order to achieve an appropriate number of shares for the Company, the board of directors proposes that the general meeting resolves on a reverse share split of the Company’s shares in accordance with c) below. In order to enable the reverse share split in accordance with the board of directors’ proposal in c) below, the board of directors proposes that the general meeting resolves on a directed share issue (equalisation issue) in accordance with b) below and amendment of the limits on the number of shares in the articles of association in accordance with a) and below.

The resolution on reverse share split according to item c) requires an amendment of the articles of association and an equalisation issue according to items a) and b) and vice versa. The board of directors thus proposes that resolutions in accordance with the board of directors’ proposals under items a), b) and c) shall be adopted as one resolution. Each proposal presented under this item 12 is conditional on the other proposals under the item.

A valid resolution under this proposal requires the support of shareholders representing at least two-thirds (2/3) of both the votes cast and the shares represented at the meeting.

- a) Amendment of the Articles of Association (number of shares)

The board of directors proposes that the meeting resolves to amend § 5 of the articles of association as follows:

|

Current wording |

Proposed wording |

|

§ 5 The number of shares shall be not less than 900 000 000 and not more than 3 600 000 000. |

§ 5 The number of shares shall be not less than 9 000 000 and not more than 36 000 000. |

- b) Directed new issue (equalisation issue)

The Board of Directors proposes that the meeting, with deviation from the shareholders’ preferential rights, resolves to issue 86 new shares as follows. The purpose is to technically facilitate the reverse split according to point c).

The new issue will enable the company’s share capital to increase by SEK 0.473.

The subscription price shall correspond to the quota value, i.e. SEK 0.0055 per share, before consolidation according to c), or a total of SEK 0.473. The subscription price has been agreed with the subscriber.

The right to subscribe for the shares shall, with deviation from the shareholders’ preferential rights, be granted only to Olsen Fond & Försäkring AB. The reason for the deviation from the preferential right is to technically facilitate the proposed merger through a new issue at a low value.

Subscription shall be made on a separate subscription list within one week from the date of the general meeting. Payment shall be made within one week from the date of the general meeting. The board of directors is entitled to extend the time for subscription and payment.

The new shares entitle to dividends from the record date for dividends that occurs after the shares have been registered with the Swedish Companies Registration Office and entered in the share register maintained by Euroclear Sweden AB.

- c) Reverse share split

The Board of Directors proposes that the Meeting resolves on a reverse share split of the Company’s shares, whereby one hundred (100) existing shares shall be consolidated into one (1) new share.

The board proposes that the general meeting authorises the board to set the record date for the reverse share split. The record date may not occur before the resolution on the reverse share split has been registered with the Swedish Companies Registration Office.

In connection with the determination of the record date for the reverse split, the board of directors shall publish the decision on the determination of the record date and shall publish details of the procedure for the reverse split.

The shareholder Sandbygård Invest AB has undertaken to contribute shares free of charge to those shareholders whose number of shares is not evenly divisible by 100. Thus, this means that all shareholders in the reverse split will hold shares corresponding to a whole number of new shares and there will be no excess shares (so-called fractions). Sandbygård Invest AB has also undertaken to round down its remaining shareholding in the Company to the nearest number that is evenly divisible by 100.

After completion of the reverse share split and the equalisation issue, the number of shares in the Company will decrease from 1,706,986,214 to 17,069,863. The proposed reverse share split also means that the quota value of the share will increase from SEK 0.0055 to SEK 0.55.

Item 13 – Proposal for resolution on a) implementation of the Incentive Programme 2024/2027A to the Company’s CEO, other key employees and certain other employees and consultants in the Company, b) directed issue of warrants and c) approval of transfer of warrants

The board of directors proposes that the annual general meeting on 3 May 2024 in JonDeTech Sensors AB (publ) (the “Company“) resolves to implement an incentive programme consisting of a maximum of 94,000,000 warrants (corresponding to 940,000 warrants after the proposed reverse share split in item 12 above) to members of the Company’s group management, other key employees and certain other employees and consultants in the Company (“Incentive programme 2024/2027A“).

In order to secure the Company’s commitments under the Incentive Programme 2024/2027A, the board of directors also proposes that the annual general meeting resolves on a directed issue of warrants in accordance with item b) below and on approval of transfer of warrants to the participants in the incentive programme in accordance with item c) below.

- Proposal for resolution on the implementation of Incentive Programme 2024/2027A for the Company’s CEO, other key employees and certain other employees and consultants of the Company.

The board of directors proposes that the annual general meeting resolves on the implementation of the Incentive Programme 2024/2027A mainly according to the following guidelines:

- Incentive Programme 2024/2027A shall comprise a maximum of 94,000,000 warrants (corresponding to 940,000 warrants after the proposed reverse share split in item 12 above). The warrants shall entitle the holder to subscribe for a maximum of 94,000,000 new shares in the Company.

- The incentive programme shall be directed to the Company’s CEO, other key personnel and certain other employees and consultants of the Company (the “Participants“) as follows.

|

· The company’s CEO shall be offered to acquire a maximum total of 24 000 000 warrants (corresponding to 240 000 warrants after the reverse share split in item 12 above). · Key personnel consisting of up to two persons shall be offered to acquire a maximum total of 10 000 000 warrants (corresponding to 100 000 warrants after the reverse share split in item 12 above). · Certain other employees and consultants consisting of up to five (5) persons shall be offered to acquire a maximum of 60,000,000 warrants (corresponding to 600 000 warrants after the reverse share split in item 12 above). |

- Proposal for resolution on a directed issue of warrants

The board of directors proposes that the annual general meeting resolves on a directed issue of a maximum of 94,000,000 warrants (corresponding to 940 000 warrants after the reverse share split in item 12 above) on essentially the following terms:

- With deviation from the shareholders’ preferential rights, the warrants may only be subscribed for by the Company. The reason for the deviation from the shareholders’ preferential rights is that the warrants may be used within the framework of Incentive Programme 2024/2027A.

- The warrants shall entitle the holder to subscribe for a maximum of 94,000,000 shares in the Company (corresponding to 940 000 shares after the reverse share split in item 12 above). Upon full utilisation, the issue means that the Company’s share capital may increase by a maximum of approximately SEK 517,000.

- Each warrant entitles the holder to subscribe for one new share in the Company during the period from 1 May 2027 up to and including 31 May 2027 or the earlier date that follows from the terms of the warrants. The subscription price for a new subscription of a share by virtue of a warrant shall be SEK 6.00 per share, which corresponds to 210.5 percent of the volume-weighted average price on Nasdaq First North Growth Market during the period from 1 March 2024 up to and including 31 March 2024 and taking into account the proposed reverse share split proposed in item 12 above. Premiums shall be added to the unrestricted premium fund.

- The Company’s subscription of warrants shall be without consideration.

- The warrants shall be subscribed for no later than 15 May 2024 on a separate subscription list. The board of directors shall be entitled to extend the subscription period. Oversubscription cannot be made.

- A new share subscribed for through the exercise of a warrant entitles the holder to a dividend for the first time on the record date for dividends that occurs immediately after the new issue has been registered with the Swedish Companies Registration Office and Euroclear Sweden AB.

- The warrants are subject to customary conversion conditions.

- Proposal for a resolution on the approval of the transfer of warrants

The board of directors proposes that the annual general meeting resolves to approve that the Company may transfer the warrants to the Participants according to the distribution under item a) above.

- The warrants shall be transferred on market terms at a price (premium) corresponding to a calculated market value for the warrants using a generally accepted valuation model (Black & Scholes) calculated by an independent valuation institute. Such valuation shall be carried out in accordance with recognised practices for the valuation of warrants. Payment for allocated warrants shall be made in cash no later than ten banking days after notification of acquisition. The warrants shall otherwise be subject to market conditions.

- The option premium amounts to SEK 0,003 per warrant.

- A condition for acquiring warrants is that the Participant has signed a special pre-emption agreement with the Company. The pre-emption agreement means that the Company, or the person designated by the Company, under certain conditions is entitled to repurchase the warrants from the Participant. Such repurchase right shall exist, for example, if the Participant’s employment ceases or if the Participant intends to transfer warrants to someone else.

- The Board of Directors of the Company is hereby authorised to prepare the necessary documentation for Incentive Programme 2024/2027A and otherwise administer the transfer to the Participants.

Background and reasons for the proposal

The purpose of the Incentive Programme 2024/2027A is to create conditions for retaining and increasing the motivation of current members of the Company’s group management, other key personnel and certain other employees and consultants in the Company. The board of directors finds that it is in the interest of all shareholders that the Participants, who are deemed to be important for the Company’s further development, have a long-term interest in a good value development of the share in the Company. A long-term ownership commitment is expected to stimulate an increased interest in the business and the earnings trend as a whole, as well as increase the motivation of the Participants and aims to achieve a greater community of interest between the Participants and the Company’s shareholders.

Dilution effect

At the time of this proposal, the total number of registered shares and votes is 1,706,986,214. If all warrants under Incentive Programme 2024/2027A are subscribed for and exercised, the number of shares will increase by 94,000,000, which corresponds to a maximum dilution of approximately 5,22 percent of the total number of shares and votes in the Company.

Other outstanding incentive programmes

At the annual general meeting on 4 May 2022, it was resolved to introduce a long-term incentive programme for senior executives and external key persons in the Company (“Warrant Programme 2022:A“) and to introduce a long-term incentive programme for the board of directors of the Company (“Warrant Programme 2022:B“). Warrant Programme 2022:A comprises a maximum of 2 000 000 warrants. Each warrant entitles the holder to subscribe for one new share in the Company at a subscription price amounting to 200 percent of the average volume-weighted price paid for the Company’s share during the period from 16 June 2022 up to and including 30 June 2022. The subscription price may not be set below the share’s quota value. The subscription period runs from 1 July 2022 up to and including 28 June 2025. Full exercise of the warrants corresponds to a dilution for existing shareholders of approximately 0.12 per cent as of the date of the notice. The warrants are subject to customary recalculation conditions. Warrant programme 2022:B comprises a maximum of 100 000 warrants. Each warrant entitles the holder to subscribe for one new share in the Company at a subscription price amounting to 200 percent of the average volume-weighted price paid for the Company’s share during the period from 16 June 2022 up to and including 30 June 2022. The subscription price may not be set below the quota value of the share. The subscription period runs from 1 July 2022 up to and including 28 June 2025. Full exercise of the warrants corresponds to a dilution for existing shareholders of approximately 0.006 per cent as of the date of the notice.

Costs and effects on key performance indicators

Since the warrants are acquired at market value, it is assessed that no social costs will arise for the Company. However, the incentive programme will entail certain administrative costs related to the preparation of the proposal, registration and share subscription with the support of the warrants. The incentive programme is not expected to have any effects on the Company’s key figures.

Preparation of the proposal

The proposal for the Incentive Programme 2024/2027A has been prepared by the Board of Directors of the Company in cooperation with external advisors.

Specific authorisation

It is proposed that the board of directors or the person appointed by the board of directors is authorised to make such minor adjustments to this resolution as may be necessary in connection with registration with the Swedish Companies Registration Office and possibly with Euroclear Sweden AB.

Majority requirements

A valid resolution under this proposal requires that the proposal is supported by shareholders holding at least nine tenths (9/10) of both the votes cast and the shares represented at the meeting.

Item 14 – Proposal for resolution on a) implementation of the Incentive Programme 2024/2027B to the members of the Board of Directors, b) directed issue of warrants and c) approval of transfer of warrants

The shareholder Jan Holmberg (the “Shareholder“) proposes that the annual general meeting on 3 May 2024 in JonDeTech Sensors AB (publ) (the “Company“) resolves to introduce an incentive programme consisting of a maximum of 17 000 000 warrants (corresponding to 170 000 warrants after the reverse share split in item 12 above) to the members of the board of directors of the Company (“Incentive Programme 2024/2027B“).

In order to secure the Company’s commitments under Incentive Programme 2024/2027B, the Shareholder also proposes that the annual general meeting resolves on a directed issue of warrants in accordance with what is stated in item b) below and on approval of transfer of warrants to the participants in the incentive programme in accordance with item c) below.

- Proposal for resolution on the introduction of the 2024/2027B Incentive Programme for members of the Board of Directors

The shareholder proposes that the annual general meeting resolves on the implementation of the Incentive Programme 2024/2027B mainly according to the following guidelines:

- Incentive Programme 2024/2027B shall comprise a maximum of 17 000000 warrants (corresponding to 170 000 warrants after the reverse share split in item 12 above). The warrants shall entitle the holder to subscribe for a maximum of 17 000 000 new shares in the Company.

- The incentive programme shall be directed to the board members of the Company (the “Participants“) as follows.

|

· Each board member shall be offered to acquire a maximum of 3 400 000 warrants, in total a maximum of 17 000 000 warrants (corresponding to a maximum of 170 000 warrants after the reverse share split in item 12 above). |

- Proposal for a resolution on a directed issue of warrants

The Shareholder proposes that the annual general meeting resolves on a directed issue of a maximum of 17 000 000 warrants (corresponding to 170 000 warrants after the reverse share split in item 12 above). on essentially the following terms:

- With deviation from the shareholders’ preferential rights, the warrants may only be subscribed for by the Company. The reason for the deviation from the shareholders’ preferential rights is that the warrants may be used within the framework of Incentive Programme 2024/2027B.

- The warrants shall entitle the holder to subscribe for a maximum of 17 000 000 new shares in the Company. Upon full utilisation, the issue means that the Company’s share capital may increase by a maximum of approximately SEK 93 500.

- Each warrant entitles the holder to subscribe for one new share in the Company during the period from 1 June 2027 up to and including 30 June 2024 or the earlier date that follows from the terms of the warrants. The subscription price for a new subscription of a share by virtue of a warrant shall be set at SEK 6.00 per share corresponding to 210.5 % per cent of the volume-weighted average price on Nasdaq First North Growth Market during the period from 1 March 2024 up to and including 31 March 2024 and taking into account the proposed reverse share split proposed in item 12 above. Premiums shall be added to the unrestricted premium fund.

- The company’s subscription of warrants shall be free of charge.

- The warrants shall be subscribed no later than 15 May 2024 on a separate subscription list. Oversubscription is not possible.

- A new share subscribed for through the exercise of a warrant entitles the holder to a dividend for the first time on the record date for dividends that occurs immediately after the new issue has been registered with the Swedish Companies Registration Office and Euroclear Sweden AB.

- The warrants are subject to customary conversion conditions.

- Proposal for a resolution to approve the further transfer of warrants.

The Shareholder proposes that the annual general meeting resolves to approve that the Company, through the CEO Leif Borg, may transfer the warrants to the Participants in accordance with the distribution under item a) above and enter into pre-emption agreements with the Participants as set out below.

- The warrants shall be transferred on market terms at a price (premium) corresponding to a calculated market value for the warrants using a generally accepted valuation model (Black & Scholes) calculated by an independent valuation institute. Such valuation shall be carried out in accordance with accepted practices for the valuation of warrants. Payment for allocated warrants shall be made in cash no later than ten banking days after notification of acquisition. The warrants shall otherwise be subject to market conditions.

- The option premium amounts to SEK 0,003 per warrant.

- A condition for acquiring warrants is that the Participant has signed a special pre-emption agreement with the Company. The pre-emption agreement means that the Company, or the person designated by the Company, under certain conditions is entitled to repurchase the warrants from the Participant. Such repurchase right shall exist, for example, if the Participant’s employment ceases or if the Participant intends to transfer warrants to someone else.

Background and reasons for the proposal

The purpose of Incentive Programme 2024/2027B is to create conditions for retaining and increasing the motivation of the current board members of the Company. The Shareholder finds that it is in the interest of all shareholders that the Participants, who are deemed to be important for the Company’s further development, have a long-term interest in a good value development of the share in the Company. A long-term ownership commitment is expected to stimulate an increased interest in the business and the earnings trend as a whole, as well as increase the motivation of the Participants and aims to achieve a greater community of interest between the Participants and the Company’s shareholders.

Dilution effect

At the time of this proposal, the total number of registered shares and votes is 1,706,986,214. If all warrants under Incentive Programme 2024/2027B are subscribed for and exercised, the number of shares will increase by 17,000,000, which corresponds to a maximum dilution of approximately 0.99 percent of the total number of shares and votes in the Company.

Other outstanding incentive programmes

At the annual general meeting on 4 May 2022, it was resolved to implement a long-term incentive programme for senior executives and external key persons in the Company (“Warrant Programme 2022:A“) and to implement a long-term incentive programme for the board of directors of the Company (“Warrant Programme 2022:B“). Warrant Programme 2022:A comprises a maximum of 2,000,000 warrants. Each warrant entitles the holder to subscribe for one new share in the Company at a subscription price amounting to 200 percent of the average volume-weighted price paid for the Company’s share during the period from 16 June 2022 up to and including 30 June 2022. The subscription price may not be set below the quota value of the share. The subscription period runs from 1 July 2022 up to and including 28 June 2025. Full exercise of the warrants corresponds to a dilution for existing shareholders of approximately 0.12 per cent as of the date of the notice. The warrants are subject to customary recalculation conditions. Warrant Programme 2022:B comprises a maximum of 100,000 warrants. Each warrant entitles the holder to subscribe for one new share in the Company at a subscription price amounting to 200 percent of the average volume-weighted price paid for the Company’s share during the period from 16 June 2022 up to and including 30 June 2022. The subscription price may not be set below the quota value of the share. The subscription period runs from 1 July 2022 up to and including 28 June 2025. Full exercise of the warrants corresponds to a dilution for existing shareholders of approximately 0.006 per cent as of the date of the notice.

Costs and effects on key performance indicators

Since the warrants are acquired at market value, it is assessed that no social costs will arise for the Company. However, the incentive programme will entail certain administrative costs related to the preparation of the proposal, registration and share subscription with the support of the warrants. The incentive programme is not expected to have any effects on the Company’s key figures.

Preparation of the proposal

The proposal for the Incentive Programme 2024/2027B has been prepared by the Shareholder in cooperation with external advisors.

Specific authorisation

It is proposed that the Company’s CEO or the person appointed by the Company’s CEO is authorised to make such minor adjustments to this resolution as may be necessary in connection with registration with the Swedish Companies Registration Office and possibly with Euroclear Sweden AB.

Majority requirements

A valid resolution under this proposal requires that the proposal is supported by shareholders holding at least nine tenths (9/10) of both the votes cast and the shares represented at the meeting.

Item 15 – Resolution to authorise the board of directors to decide on issues of shares, warrants and convertibles

The board of directors proposes that the annual general meeting resolves to authorise the board of directors to – on one or more occasions and until the next annual general meeting – resolve to increase the Company’s share capital by issuing new shares, warrants and convertibles within the limits permitted by the articles of association from time to time.

A new issue of shares, warrants and convertibles may be made with or without deviation from the shareholders’ preferential rights and with or without provisions on non-cash, set-off or other conditions. According to Chapter 16. Of the Swedish Companies Act, the board of directors is not entitled to use this authorisation to decide on issues to board members of the group, employees etc. Issues decided on the basis of the authorisation shall be made on market terms.

The purpose of the authorisation and the reasons for any deviation from the shareholders’ preferential rights is to enable new issues of shares, warrants and convertibles to be made in order to increase the Company’s financial flexibility and/or the Board’s room for action.

For a resolution under this paragraph to be valid, the proposal must be supported by shareholders representing at least two-thirds (2/3) of both the votes cast and the shares represented at the meeting.

Item 16 – Resolution to authorise the board of directors to make minor adjustments to the resolutions adopted by the general meeting.

The board of directors proposes that the meeting authorises the board of directors, the CEO or the person otherwise appointed by the board of directors to make such minor adjustments and clarifications of the resolutions adopted at the meeting to the extent required for registration of the resolutions.

OTHER

Shareholders’ right to receive information

According to Chapter 7, Section 32 of the Swedish Companies Act, shareholders have the right to request information from the board of directors and the CEO regarding circumstances that may affect the assessment of an item on the agenda or the Company’s financial situation. The board of directors and the managing director shall disclose such information if the board of directors considers that it can be done without significant harm to the Company.

Processing of personal data

The personal data collected from the share register maintained by Euroclear Sweden AB, received notifications, postal voting forms and information on proxies and assistants will be used for registration, preparation of the voting list for the general meeting and, where applicable, the minutes of the meeting. For further information on how your personal data is processed, see www.euroclear.com/dam/ESw/Legal/Integritetspolicy-bolagsstammor-svenska.pdf.

Documents

The accounting documents with accompanying audit report will be available at the Company and on the Company’s website, www.jondetech.se, for at least three weeks before the annual general meeting. The board of directors’ complete proposals for resolutions, postal voting forms and other required documents will be made available to shareholders at the Company no later than three weeks before the meeting and will be sent free of charge to shareholders who so request and provide their postal address or e-mail address. Copies of the said documents shall also be sent to those shareholders who so request and state their postal address or e-mail address.

Number of shares and votes

At the time of issuing this notice, the total number of shares and votes in the Company amounts to 1,706,986,214. The Company holds no own shares.

_____________________________

Stockholm in April 2024

JonDeTech Sensors AB (publ)

Board of Directors

For more information, please contact:

Leif Borg, CEO, tel: +46 73 810 93 10, [email protected]

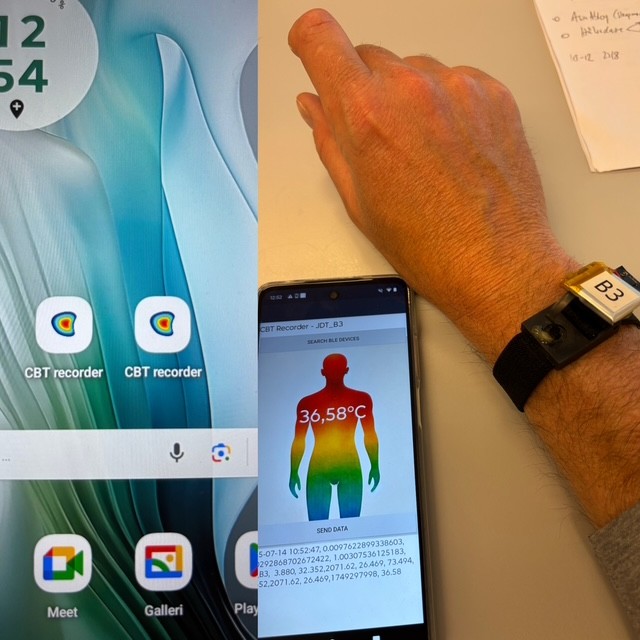

About JonDeTech

JonDeTech is a supplier of sensor technology. The company markets a portfolio of IR sensor elements based on proprietary nanotechnology and silicon MEMS. The nanoelements are extremely thin, built-in flexible plastic, and can be manufactured in high volumes at a low cost, which opens up for a variety of applications, such as temperature and heat flow measurements, presence detection, and gas detection. The company is listed on Nasdaq First North Growth Market.

Mangold Fondkommission AB is the company’s Certified Adviser.

Read more at www.jondetech.se or see how the IR sensor works at www.youtube.com/watch?v=2vEc3dRsDq8.